By Athanasios Pitatzis

It was first published on OilVoice at 27th of April 2016, http://www.oilvoice.com/n/ENI-upstream-activities-A-strategic-management-approach/74b3dfa19f62.aspx

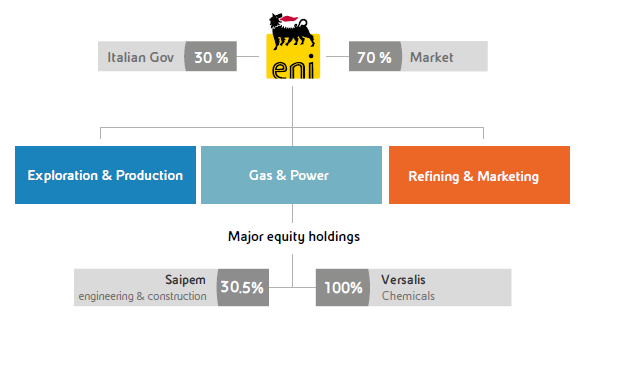

According to the official website of the company ENI is “a major integrated energy company committed to growth in the activities of finding, producing, transporting, transforming and marketing oil and gas”. ENI corporate structure presented in the below graph.

ENI Corporate Profile, Source: ENI Corporate Fact Sheet, March 2016, http://www.eni.com/en_IT/home.html

ENI Upstream Activities

ENI exploration and production business unit is operating currently in 42 countries. Some of these countries in which ENI is active in the field of the exploration of hydrocarbons are Italy, Egypt, Venezuela, Angola, Ghana, UK, Mozambique, Nigeria, Libya and the United States. According to the ENI Corporate Fact Sheet of March 2016 the key statistics of the company E&P business unit for the year 2015 are:

- Capital Expenditure (CAPEX) of € 10.2 Billion

- Adjusted net Profits of € 4.1 Billion

- 76 Mboe/d of oil and gas liquids production

- 9 bln boe of proved reserves with a life index of 11 y

- 148% organic reserve replacement ratio

Some of the major oil and gas fields which will start production in the next 4 years (2016-2019) according to the future business strategy of the company are:

- Goliat field in Norway which has started production some days before (65 equivalent kboed estimated/proven reserves, ENI is the operator)

- Kashaghan field in Kazakhstan which will start production during the second semester of 2016 (65 equivalent kboed estimated/proven reserves, ENI is not the operator).

- Jangkrik field in Indonesia which will start production during the first semester of 2017 (40 equivalent kboed estimated/proven reserves, ENI is the operator).

- Marine XII field in Congo, which will start production in the upcoming four years, (150 equivalent kboed estimated/proven reserves, ENI is the operator).

- OCTP field in Ghana which will start production during the second semester of 2017 (40 equivalent kboed estimated/proven reserves, ENI is the operator).

- 15/16 East Hub field in Angola which will start production during the second semester of 2017 (45 equivalent kboed estimated/proven reserves, ENI is the operator).

- Zohr gas field in Egypt which will start production during the second semester of 2017 (More than 400 equivalent kboed estimated/proven reserves or more than 850 billion cubic meters of natural gas, ENI is the operator).

According to the above the company has a well-established portfolio of upstream assets which is geographically distributed worldwide. In the period 2008-2015 the company has discovered 12 billion boe, which is 2.4 times what they have produced in the same period. In comparison, its peers have an average ratio of 0.3.

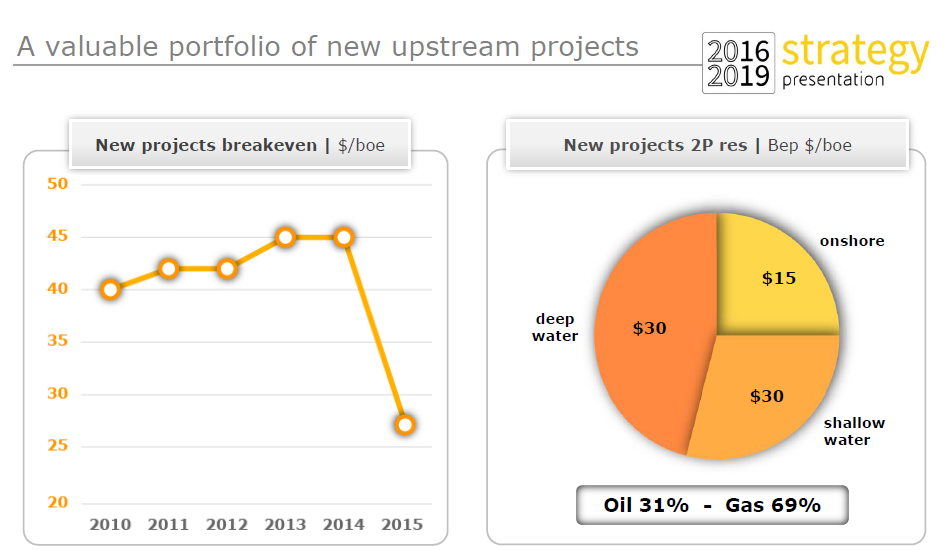

ENI upstream breakeven price, Source: ENI Strategic Presentation 2015-2019, http://www.eni.com/en_IT/investor-relation/presentations-reports/presentations/2016/presentation-2016-2019-strategy.shtml

According to the above graph, it is obvious that ENI is trying to adjust to a new dynamic low oil – gas prices business environment. This business adjustment has achieved already significant results, there are:

- The average breakeven oil/gas price of the new upstream projects of ENI has lowered from 45 $/bbl to 27 $/bbl in one year

- 18% reduction in overall upstream CAPEX

- ENI has reduced the target oil price under which full-year CapEx was funded by operating cash flow down to $50 per barrel in 2015 vs. their previous guidance of $63 per barrel for the period 2015-2016

- Onshore upstream projects breakeven oil price is 15$/bbl while shallow and deep water around 30$/bbl

ENI Mozambique Upstream Activity

ENI gas discoveries in Mozambique are important, and there are estimated to hold more than 80 TCF of proven reserves. (Both Mamba and Coral gas fields). Recently ENI received approval from Mozambique government for the development of Coral gas field (5 TCF) and according to the company an FLNG vessel will be built to connect this field with international gas markets.

Mozambique geographical location is ideal for fueling the worlds energy needs, Source: ENI official Corporate Presentation

Recently according to the international news, Exxon Mobil seems to interest to buy from ENI a stake of around 15 percent in Area 4 gas field. Finally, since December 2015, ENI has announced that will develop in a joint venture with Anadarko (which also operates in the country and possess Area 1 which estimated with 45 to 70 Tcf of recoverable gas resources) an LNG export terminal in Mozambique.

From the strategic point of you ENI upstream activities in Mozambique have many advantages:

- Mozambique located near to Asia huge consumers of natural gas, so the LNG export terminal development is a strategic option in a long-term view

- ENI can sell natural gas to South Africa through pipeline which expected to be one of the new emerging rising natural gas consumers

ENI upstream activities in Egypt and East Mediterranean

ENI is operating in Egypt the last 60 years and recently has discovered the Zohr gas field which is estimated to hold 30 trillion cubic feet of lean gas in place. This field is considering the biggest gas discovery in Egypt and the Mediterranean Sea and is expected to ensure satisfying Egypt’s natural gas demand for decades. Also, ENI through Union Fenosa Gas (50% ENI, 50% Gas Natural Fenosa), holds 40% of Segas export LNG terminal in Damietta. The unique discovery of Zohr gas field by ENI based on a different geological model.

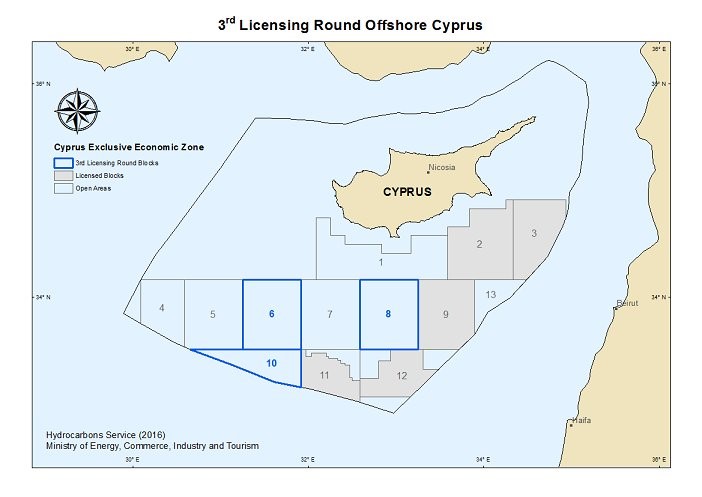

Moreover, ENI possesses three blocks in Cyprus EEZ which after Zohr discovery seems, even more, promising from the geological point of view. Probably ENI will participate in the new Cyprus offshore licensing round which will be launch during this year.

3rd Licensing Round Offshore Cyprus, Source: http://www.ogj.com/articles/2016/03/cyprus-opens-third-offshore-licensing-round.html

ENI possess 2, 3 and 9 block of Cyprus EEZ in cooperation with Kogas.

SWOT Analysis of ENI upstream business segment

Strengths

- Strong Financial Position

| ENI | 2011 | 2012 | 2013 | 2014 | 2015(1) | 2015Q4(1) | |

| Production of oil and gas

Leverage |

Mboe/d

|

1.6

|

1.7

|

1.6

|

1.6

|

1.8

|

1.9

|

| Eni adj. Operating profit | € billion | 17.9

|

19.0

|

12.6

|

11.6

|

4.1

|

0.9

|

| Eni adj. Net profit | € billion | 6.9

|

7.1

|

4.4

|

3.7

|

0.3

|

-0.2

|

| Capital expenditure | € billion | 13.4

|

12.7 | 12.8

|

12.2

|

10.8

|

2.7

|

| Net cash flow from operations | € billion | 14.4

|

12.3

|

11.0

|

15.1

|

12.2

|

4.0

|

| Net debt | € billion | 28.0

|

15.5

|

15.8

|

13.7

|

11.7

|

11.7

|

| Leverage | ratio | 0.46 | 0.25 | 0.25 | 0.22 | 0.22 | 0.22 |

(1) Shown pro-forma net of Saipem and Versalis .

Source: ENI

- Significant upstream exploration success records the last 5 years

- Diversified upstream portfolio of assets, operating in more than 42 countries

- Well-positioned in new very promising areas for oil and gas exploration such as East Mediterranean and East Africa

- Long – term operating success in complex geopolitical environments such as Egypt, Libya, Venezuela and Africa

- New exploration wells for the next 4 years (2016-2019). According to the strategic plan of ENI, the company is planning to drill 94 wells in 25 different countries targeting 1.6 billion boe of new resources

- Several oil and gas mature fields are expected to start production until 2019 such as Zohr gas field in Egypt and Kashagan oil field in Kazakhstan

- New projects break-even oil price at 27$ per barrel

- ENI upstream portfolio consists of conventional assets which are cheaper regarding production and development in comparison with unconventional resources such as shale gas, shale oil, and oil sands.

Weaknesses

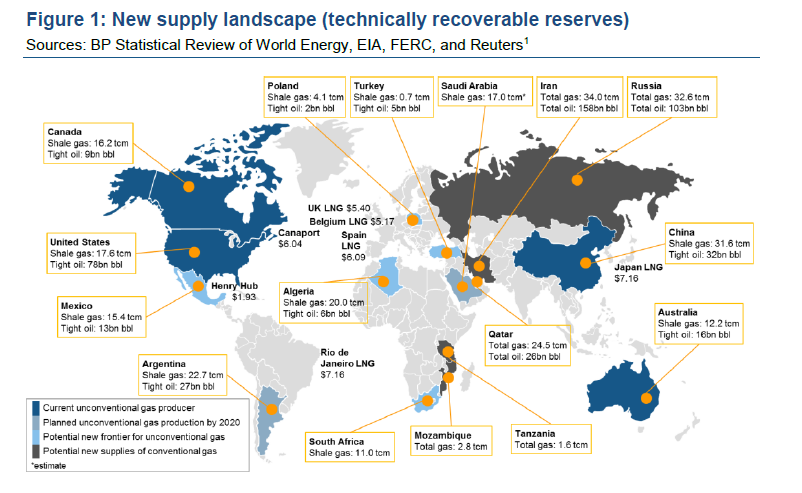

- No business presence in the unconventional resources which will play a significant role in the upcoming decades and will generate a big share of the future oil and gas production (observe the map below)

World’s Energy Council, Report World Energy Resources Unconventional gas a global phenomenon, 2016

- The new lower upstream expenditure plan can affect the proven reserves of the company in long-term, of course, this business move necessary due to the long-sustained low oil price environment.

Generally speaking, the company is performing very well the last four years, and it seems that will not only survive in this low oil price environment but will increase its future business prospects by focusing on main core business units like upstream.

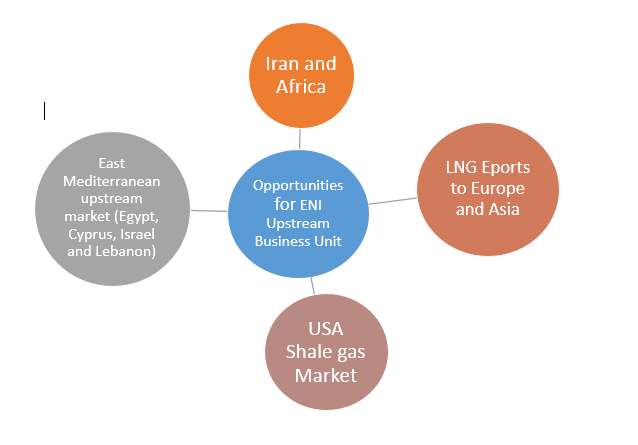

Opportunities

- Reactivate in Iran oil and gas market due to the elimination of international sanctions from the EU after the nuclear deal

- Participate in the Cyprus third licensing offshore round

- Participate in the new Egypt licensing offshore round for the West Mediterranean/part of Egypt EEZ which seems very promising according to PGS

- Participate in the new Norway offshore licensing round which according to the Norwegian Ministry of Petroleum and Energy will be contain 24 blocks in the Norwegian Sea and 32 blocks in the Barents Sea

- Exporting LNG to Europe through Damietta LNG export terminal in Egypt. The gas quantities for exports for this terminal can be obtained from Aphrodite (Cyprus), Zohr (Egypt), Leviathan and Tamar (Israel) gas fields through undersea pipelines

- Exporting LNG to Asia though Mozambique future LNG export facilities

- Merge or acquire some small USA shale gas companies. Through this business move, ENI will acquire the know-how to explore unconventional resources

- Merge or acquire one or more small companies which are operating in the Balkan region

Threats

- Geopolitical instability in Africa which is one of the main business core of ENI upstream business segment

- Low oil prices below 50$ per barrel after 2017

- Delays in the future production of oil and gas from the new projects that are under development right now

- Decreasing global economic growth due to China slow economic growth

- Intensive competition from the other major companies such as Shell and Exxon Mobil

- Future intensive competition in the upstream sector in Africa from China National Oil companies

- Currency war, For example, it is known that the last century after WW II dollar is the main reserve currency until today, but the last decade we have and other coins to compete for dollar in global scales such as Euro, Chinese Yuan, and Russian Ruble

- Over debt countries globally, this situation can affect global economic growth and the outcome of this situation will decrease the demand for oil and gas

Conclusion

ENI prospects are very promising, and their business strategy to reduce the costs and their new disposal program targets €7 billion of asset sales mainly from the dilution of high working interest stakes in recent material discoveries seems logical in this low oil price environment.

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Member of the Greek Energy Forum. He specializes in the development of oil & gas markets in Southeast Europe and the Mediterranean. Also, he is the owner of the website Energy Routes in which he publish all of his articles for global oil and gas industry, http://energyroutes.eu/ The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis.

Leave a comment