By Athanasios Pitatzis

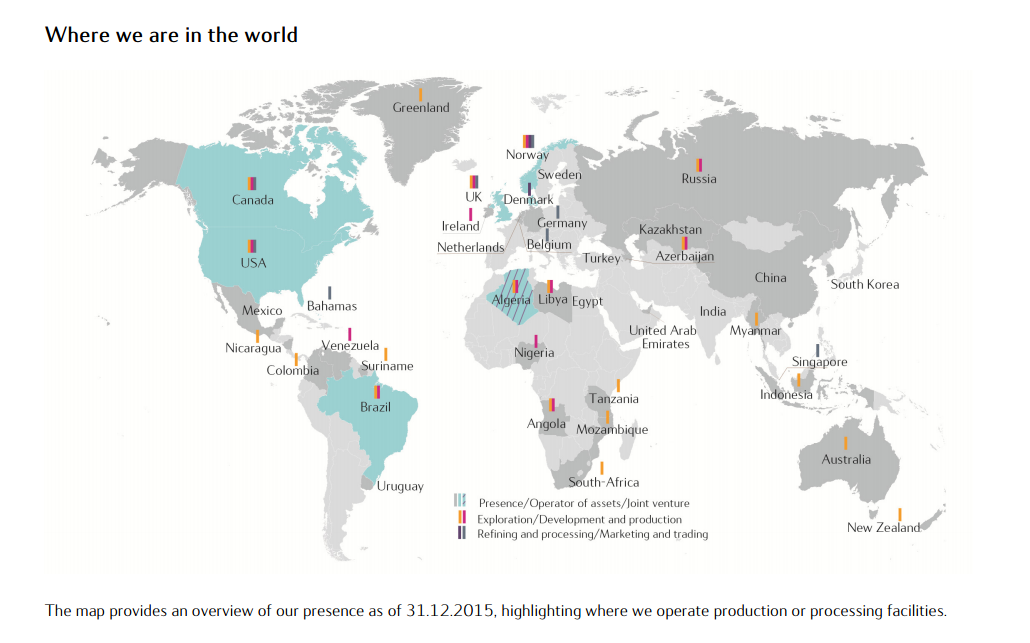

Statoil is one of biggest National Oil Company (NOCs) (despite the fact that is listed on the largest exchange stock markets of the world, 67 % Norwegian state ownership) in the world, but its global business operations are comparable and in some cases even better than those of the most major International Oil Companies (IOCs). Statoil operates in many countries globally, with its primary business operations to located in Norway but with a significant market presence in Brazil, UK, Canada, Algeria and of course the USA.

Statoil Global Business Presence, Source: Statoil Sustainability Report 2015

In today’s article will emphasise the major strengths and weaknesses of Statoil global business strategy. Also, we will recommend some future strategic moves for Statoil which will help the company to compete in global scale and especially in a long-low oil price business environment.

Our strategic business analysis is focusing on the upstream business segment of Statoil.

Strengths of Statoil Upstream Global Business Strategy

The major/obvious advantages of Statoil Upstream Global Business Strategy are:

- Statoil is the second biggest gas supplier to Europe

- Significant Proved Oil and Gas Reserves

- Significant Upstream Business Presence in the North Sea (UK and Norway)

- Increasing Corporate Transparency with the introduction of a new report “Payments to ”

- Statoil oil and gas reserves located near to one of the biggest global oil and gas consumers, the European Union

- Statoil upstream business portfolio is distributed globally

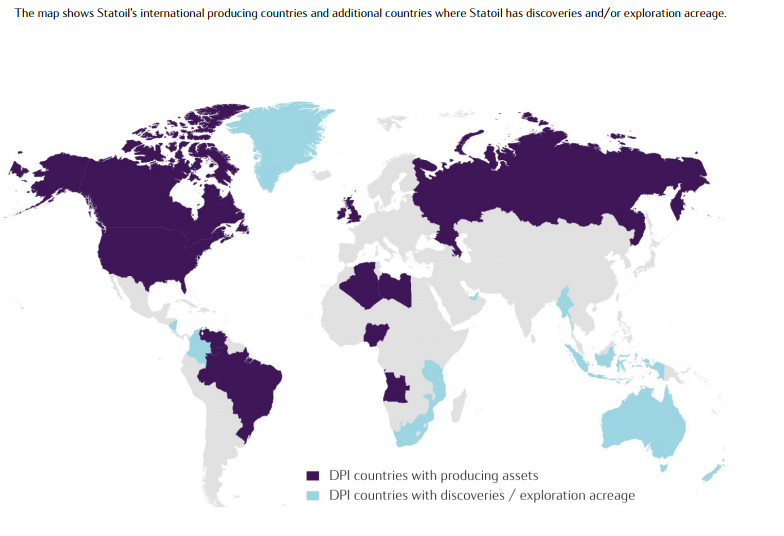

Development and Production International (DPI) Business Assets, Source: Statoil Sustainability Report 2015

- Innovation within the company. For instance, according to the Annual Report of the year 2015 Statoil started in 2015 the world’s first subsea gas compression plant at the Åsgard field

- Strategic sales of oil and gas assets in sensitive geopolitical areas such as the remaining 15.5% interest in Shah Deniz and the South Caucasus Pipeline (SCP) to the Malaysian oil and gas company PETRONAS

- According to the Annual Report 2015, Statoil’s entitlement production outside Norway was about 32% of Statoil’s total entitlement production in 2015

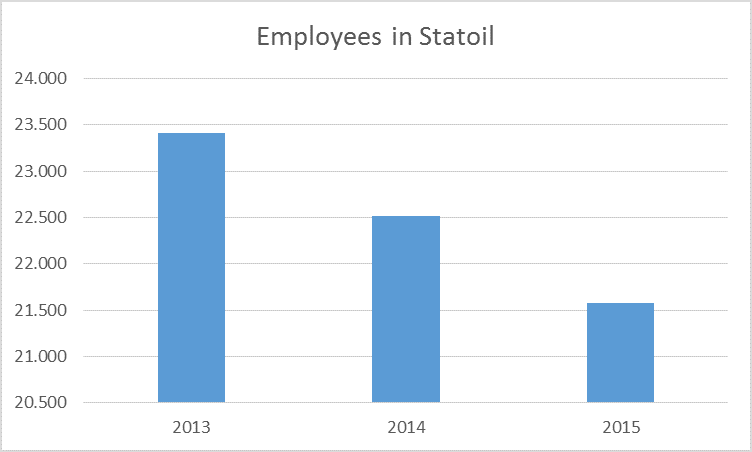

- Maintain the number of employees until the end of 2015 relatively the same with a small decline (observe the graph below)

Employees in Statoil per year, Source: Statoil’s Annual Report 2015

- Decreasing frequency of incidents (per million hours worked) since 2011

Serious Incident Frequency, Source: Statoil’s Annual Report 2015

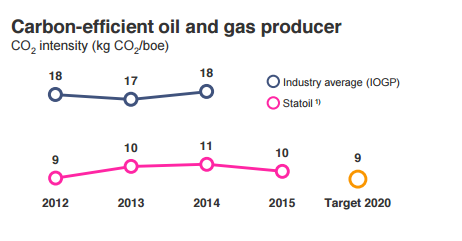

- Decreasing the business environmental footprint of its global operations. Extremely well performed in comparison with the industry average in this hot topic.

Carbon-efficient oil and gas producer, Source: Statoil’s Corporate Presentation European Credit Investor Update, September 2016

- Upstream Focus – World’s largest offshore operator (Water Depths > 100 meters). Operating more than 3 Mill. Boed

- New Business moves to diversify its Business Portfolio, increasing investment in the renewables (observe the articles below)

Related Articles:

- Statoil renewables chief: aims to cut offshore wind cost by 40 pct

- Statoil, partners start deep geothermal drilling in Iceland

- Exxon, Shell, Total, Statoil renew clean energy drive

- Statoil expands its wind farm portfolio

- Statoil Increases Stake in UK Offshore Wind

- on, Statoil mark construction start for 385-MW Arkona offshore wind farm

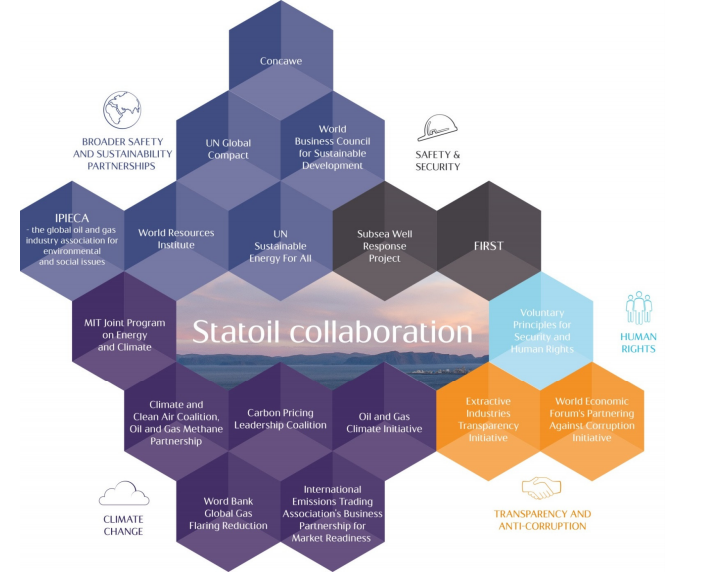

- Strategic Cooperation with International Organizations which are related to Global Energy and Climate Change Policies

Statoil’s Strategic Cooperation with International Organizations, Source: Statoil Sustainability Report 2015

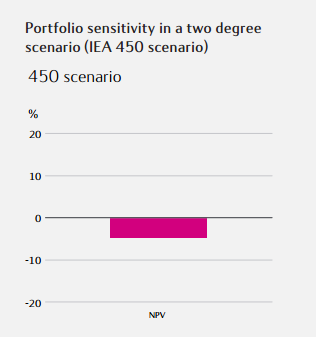

- Taking into consideration the Climate Change, the company has launched a strategy in their Statoil Sustainability Report 2015 regarding “if the IEA (International Energy Agency) 450 scenario would have an adverse impact of about 5% on Statoil’s NPV compared to our planning assumptions as of December 2015 (graph down). This reflects sensitivity to oil and gas prices and carbon price as well as changes to the portfolio due to the NPV effect on particular projects.”

Portfolio sensitivity in a two-degree scenario (IEA 450 scenario), Source: Statoil Sustainability Report 2015

- Increasing active business cooperation with Brazil National Oil Company Petrobras in Brazil read the related article “Statoil and Petrobras strengthen strategic partnership in Brazil.”

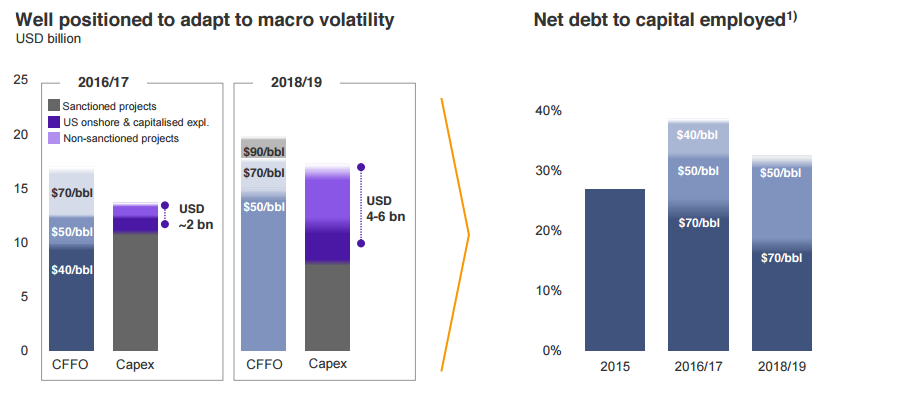

- Maintaining flexibility in an improved portfolio, as it mentions by Statoil’s Corporate Presentation European Credit Investor Update the company net cash flow can be neutral at $60/bbl in 2017 and $50/bbl in 2018

Maintaining flexibility in an improved portfolio, Source: Statoil’s Corporate Presentation European Credit Investor Update, September 2016

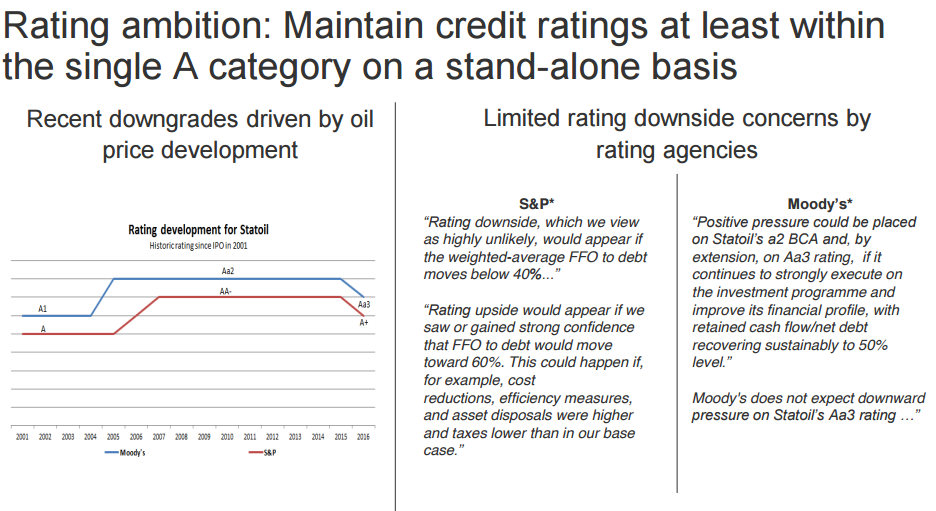

- Maintain Credit rating in beneficial and acceptable levels

Statoil’s Credit Ratings by Moody’s and S&P, Source: Statoil’s Corporate Presentation European Credit Investor Update, September 2016

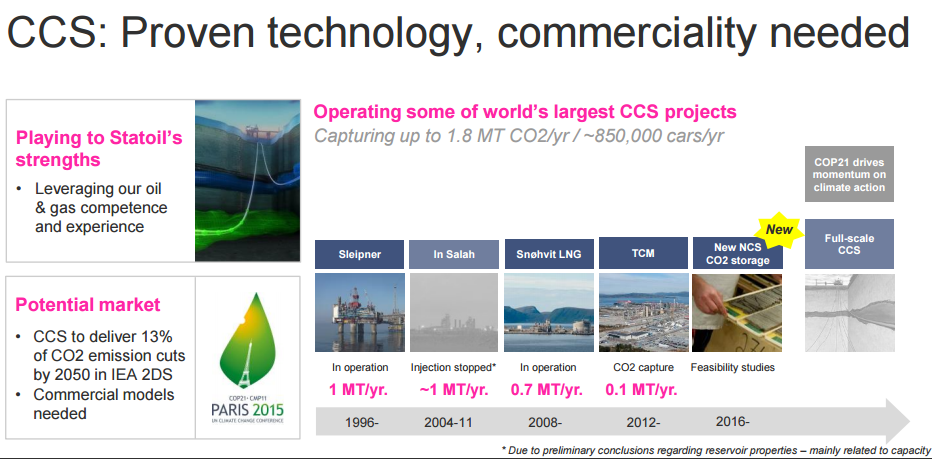

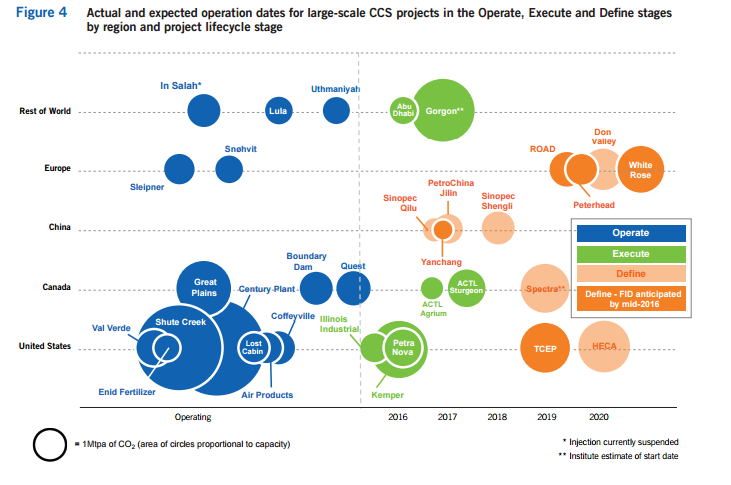

- Strategic business competitive advantage regarding the global market of the CCS (Carbon Capture and Storage) projects, which is a promising and with increasing value industry (especially in the EU area)

Statoil’s Carbon Capture and Storage projects, Source: Statoil’s Corporate University New energy solutions in Statoil, January 2016

Weaknesses of Statoil Upstream Global Business Strategy

The major/obvious weaknesses of Statoil Upstream Global Business Strategy are:

- Increasing role of the Norwegian state in the management of the company in a long – term low oil price business environment, with a primary objective to cover its national budget

- Host governments in which Statoil operates can increase taxes, put new restrictions on exploration, production, imports and exports or nationalised Statoil business assets

- High dependence on European Gas Market

- Intense competition with Russia (Gazprom), Algeria and Azerbaijan over European Oil and Gas Market

- Most of the profit of the company derived from oil and gas sales

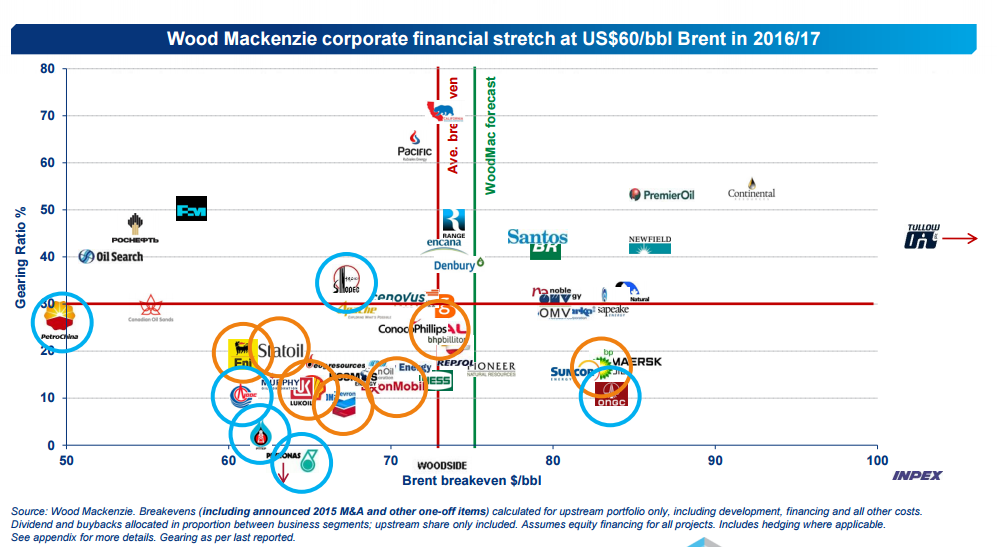

- Intense competition with Major Integrated Oil and Gas Companies and National Oil Companies (despite the global competition, it is evident from the below graph that Statoil is well positioned to the global competition in oil and gas industry). Intense competition can guide a company to efficiency and innovation but also to self – destruct business strategy, for that reason we believe, is a weakness for Statoil in the long-term.

Wood Mackenzie corporate financial stretch at US$60/bbl Brent in 2016/17, Source: Wood Mackenzie Corporate Presentation, Paris Briefing Adapting to the challenge of low oil prices, July 2015

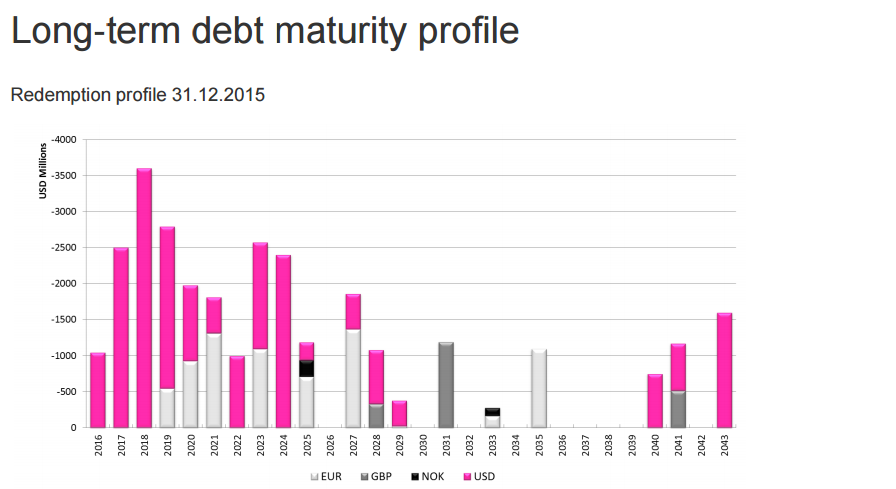

- Short – Term Debt profile (the next ten years, observe the graph below) of the company can increase the pressure on the company balance sheet if global low oil and gas prices stay at these levels for the next 3-5 years

Statoil’s Long-Term Debt Maturity Profile, Source: Statoil’s Corporate Presentation European Credit Investor Update, March – April – June 2016, Philippe F. Mathieu, SVP and Head of Finance, Arild Dybvig, Lead Finance – Corporate Financing

- Small business presence in the Global LNG Market (based on the below graph, Norway LNG exports are only 5.3% of the total Norway gas exports)

Norwegian natural gas exports in 2015, by first delivery point, Updated: 25.05.2016, Source: Norwegian Petroleum Directorate and Gassco, http://www.norskpetroleum.no/en/production-and-exports/exports-of-oil-and-gas/

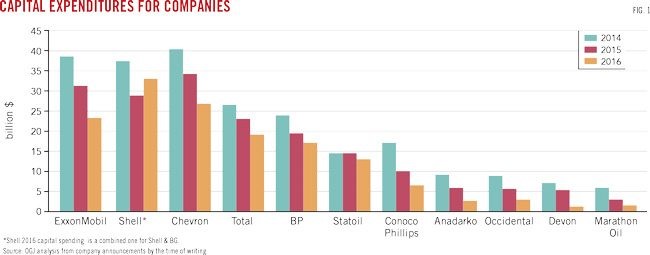

- Reducing CAPEX of Statoil will affect the future growth of the company

Capital Expenditures for Oil and Gas Companies, Source: By Conglin Xu , Senior Editor, Capital expenditures to be squeezed further in 2016, Oil and Gas Financial Journal, July 2016

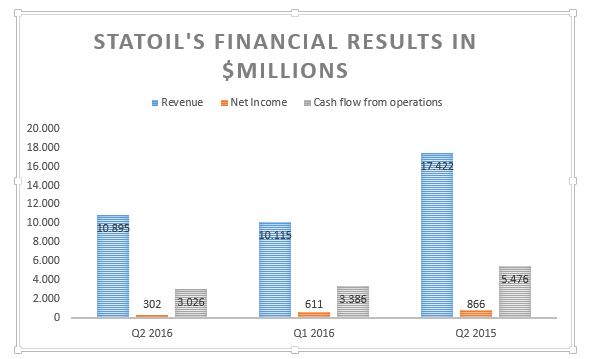

- Poor economic performance of the company until the Q2 of 2016 (second quarter of 2016)

Statoil’s Financial Results for the Q2 of 2016, Source: Statoil’s Second Quarter of 2016 Press Release

Future Strategic Moves by Statoil in a long-low oil and gas prices global business environment

The future business strategies of Statoil Upstream Business Segment which will maintain its competitive advantage over its competitors should be:

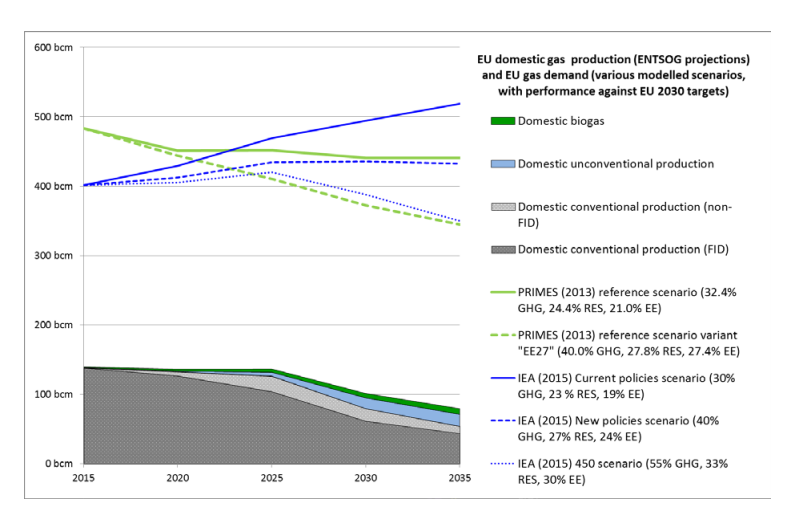

- Maintain Statoil’s market share in European Gas Market. At the same time, the company should increase its business efficiency and decrease its costs of production, so to be able to compete with Russia (Gazprom) and US LNG exporters over Europe. Taking into consideration that European gas imports will increase (observe the graph below) in the medium-term the previous strategy is essential for the future revenues of Statoil.

Future EU domestic gas production and EU gas demand, Source: European Commission Report for EU strategy for liquefied natural gas and gas storage, http://ec.europa.eu/index_en.htm

- Invest in CCS (Carbon Capture and Storage) projects, which is an emerging industry. According to Global CCS Institute report “The Global Status of CCS of the year 2015” until today 15 large-scale projects are in operation (Operate stage) and seven due to become operational in 2016 and 2017 (presently in the Execute stage), there are a further 11 projects in advanced planning (Define stage). These 11 projects have a combined CO2 capture capacity of around 15 Mtpa. Statoil can invest further in the R&D of these projects or can buy a share from existing and expected future operating projects.

Actual and expected operation dates for large-scale CCS projects, Source: Global CCS Institute report “The Global Status of CCS of the year 2015”

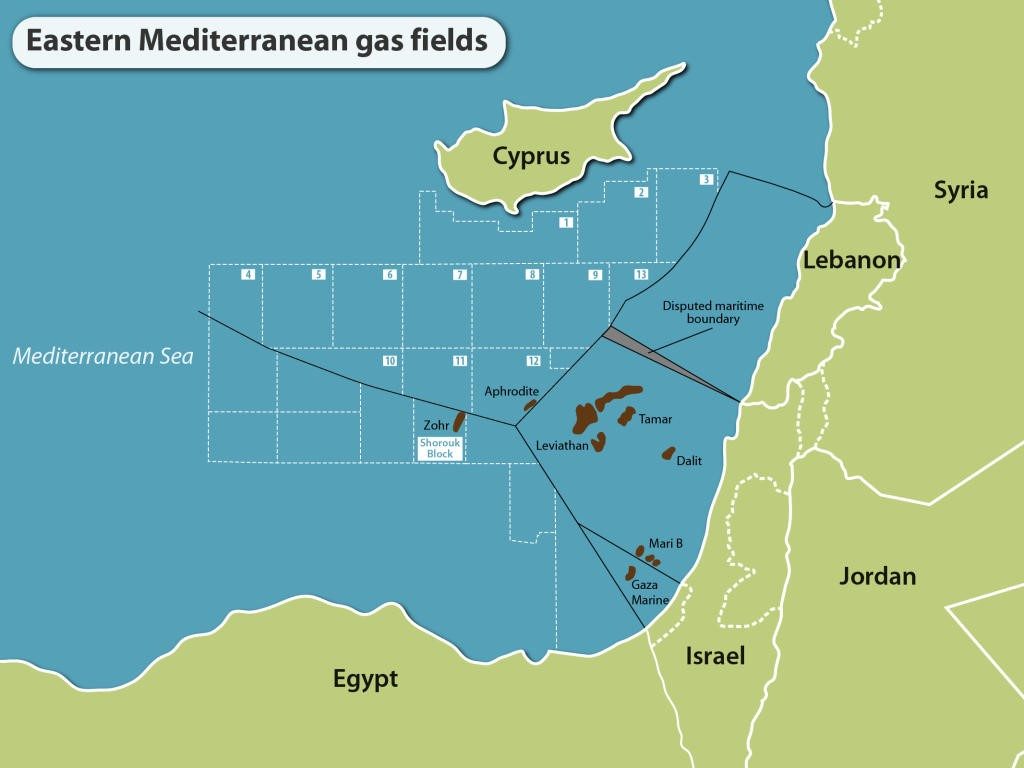

- Expand the international upstream program of the company to the South – East Mediterranean. Firstly, we propose to the company to invest in Cyprus, Israel and Egypt Exclusive Economic Zones (EEZ) and maybe shortly to Greece and Lebanon EEZ. Also, this region exploration prospects seems very promising after the discovery of the giant gas field Zohr by ENI during 2015. In this region, ENI, Total, BP, and Noble Energy are already operating and recently Exxon Mobil bid for the block 10 of the Cyprus EEZ. Taking into consideration the massive experience of Statoil to deep-water drilling environments like the North Sea, East Mediterranean oil and gas fields will add a significant competitive advantage to the company business portfolio. Also, if the gas from East Mediterranean starts to export to Europe, Statoil’s involvement in the region will maintain at least and increase in the future its market share in European Gas Market.

East Mediterranean Gas Fields, Source: Politics, economics still stifle Eastern Mediterranean gas, Crystol Energy, 10 March of 2016, http://www.crystolenergy.com/politics-economics-still-stifle-eastern-mediterranean-gas/

- Provide services which eliminate the environmental impact of the extraction of shale gas and oil sands in the other major competitors like Shell and Exxon through R&D Innovation

- Technology R&D innovation in the field of exploration of Methane Hydrates which can lead the company to become the major oil and gas player globally.*

- Strategic alliance with JOGMEC (Japan Oil, Gas and Metals National Corporation) and Baker Hughes which succeed the first drilling operation in Methane Hydrates. Access to the know-how of this technology- Competitive advantage. *

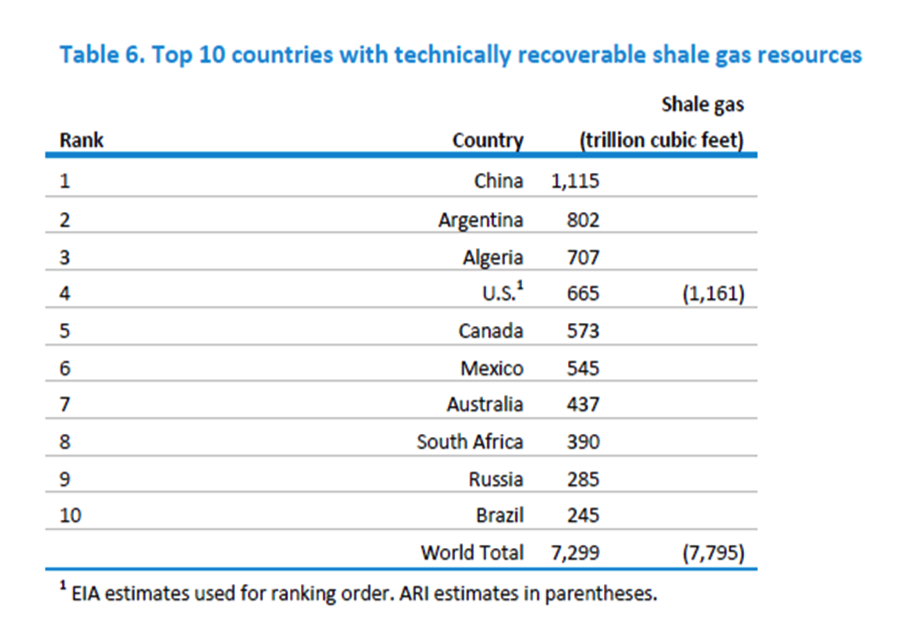

- Focus on development of shale gas in China, USA, Mexico and Argentina, between to top ten countries which have the biggest shale gas reserves according to EIA.

Source: Report from U.S. Energy Information Administration Statistics, I., 2013. Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries outside the United States, June 2013

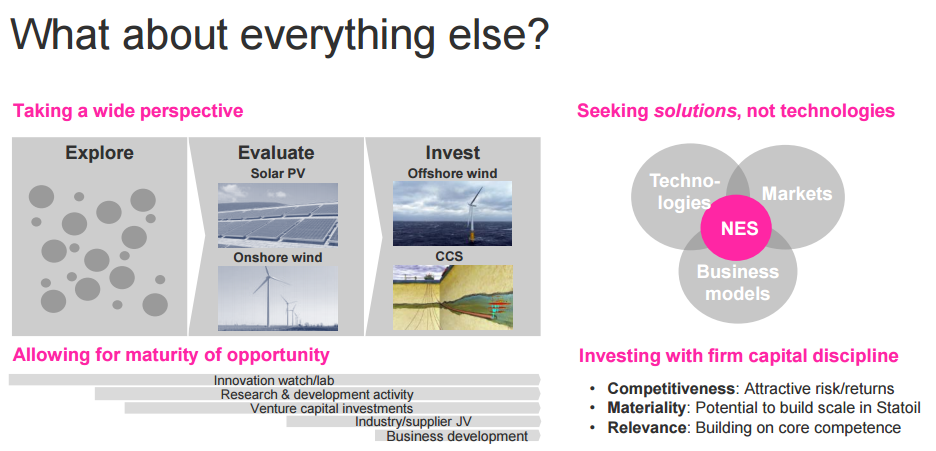

- To diversify its business portfolio, though expansion and investments in the Renewable sources of energy (Solar, Wind, Geothermal, ..)

Statoil’s New Business Segment/Direction, Source: Statoil’s Corporate Presentation “New energy solutions in Statoil.”

Conclusion

Based on the above, it is evident that our analysis is a small version of a SWOT Analysis for the Statoil Upstream Global Business Strategy. From our analysis is missing the global business threats which can affect the future business performance of Statoil’s and which described analytically in the two following articles:

- Porter’s Five Forces Model for the Oil & Gas Industry

- PEST Analysis for global oil and gas companies operations

Statoil prospects are very promising, and their business strategy to reduce their business carbon footprint and to invest heavily in the renewables and to CCS projects seems logical in this low oil price environment.

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Member of the Greek Energy Forum. He specialises in the development of oil & gas markets in Southeast Europe and the Mediterranean. Also, he is the owner of the website Energy Routes in which he publishes all of his articles for global oil and gas industry, http://energyroutes.eu/ The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis.

*More information about the Methane Hydrates in the following articles written by me:

- Methane Hydrates: A Business Opportunity for NOCs in the Middle East and Large IOCs? By Athanasios Pitatzis, https://energyroutes.eu/2016/04/06/methane-hydrates-a-business-opportunity-for-nocs-in-the-middle-east-and-large-iocs/

- Methane Hydrates: Fuel of the future as it called, and its geopolitical footprint in the global energy map, By Athanasios Pitatzis, https://energyroutes.eu/2015/11/10/methane-hydrates-fuel-of-the-future-as-it-is-called-and-the-geopolitical-footprint-in-the-global-energy-map/

Leave a comment