By Athanasios Pitatzis

First Greek Pulication: 25/01/2018 and republish of the English Version on 14/04/2018 by Foreign Affairs the Hellenic Edition, https://www.foreignaffairs.gr/

Link for the photo profile of this article: http://seanews.co.uk/supporting-innovation-in-lng-carriers/

In recent years, and especially after 2014, the Global Liquefied Natural Gas (LNG) market has evolved and transformed into a “global” and fully integrated market. There is a growing trend of competition between emerging LNG exporting countries such as the USA, Australia, and Russia, for which country will gain the largest market share of the Global LNG Market. Of course, the biggest fact regarding the Global LNG Market is the dominant position held by Qatar as the largest exporter of the Liquefied Natural Gas (LNG).

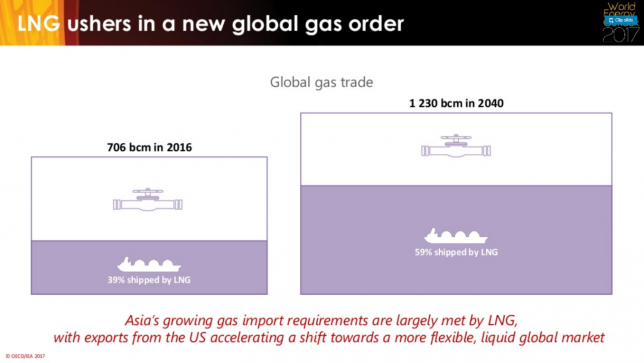

Global Gas Trade through Pipelines and Liquefied Natural Gas (LNG) in 2016 and forecast for 2040, Source: International Energy Agency, World Energy Outlook 2017, https://www.iea.org/weo2017/

According to the above graph, the global gas trade in 2016 was 706 billion cubic meters, of which 39% was LNG, so 282.4 billion cubic meters of natural gas transported via LNG ships. It is also predicted by the International Energy Agency (IEA) that the global gas trade in 2040 will be 1.230 billion cubic meters or 1,230 trillion cubic meters, of which 59% will be transported via LNG Ships.

The Global LNG trade will play a vital role in the future energy security of Europe and Southeast Asia.

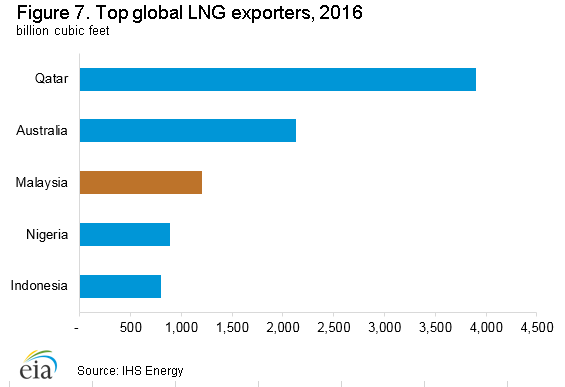

Top Global LNG exporters for 2016, Source: U.S Energy Information Administration (EIA), EIA: Malaysia Oil Market Overview, Hellenic Shipping News Website, http://www.hellenicshippingnews.com/eia-malaysia-oil-market-overview/

According to the diagram above, the top Global LNG exporters for 2016 were:

- Qatar

- Australia

- Malaysia

- Nigeria and

- Indonesia

A complicated commodity market, which will cause many geopolitical upheavals over the next fifteen years into the global geopolitical energy ecosystem. Some of these upheavals will be:

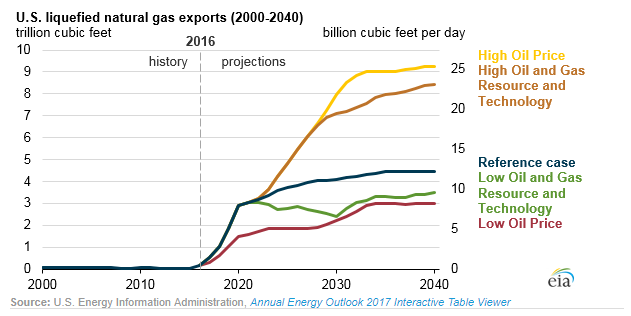

- Establishment of the global geopolitical hegemony of the US not only military via aircraft carriers but also economically through LNG export ships, which will deliver shale gas from the USA to the rest of the world. Of course, we should emphasize that to maintain and increase the USA its gas production, tens of billions of dollars have to be spent in exploration and production of conventional and non-conventional natural gas fields. Shale gas production is a difficult process, and maintaining production at high and commercial levels will be one of America’s biggest oil industry’s challenges for the next decade. Exploitation costs will play an important role in the final sale price of US LNG on world markets and whether it will be competitive.

US Exports of Liquefied Natural Gas (LNG) from 2000 to 2016 and forecast up to 2040, Source: U.S Energy Information Administration (EIA), Liquefied natural gas exports expected to drive growth in U.S. natural gas trade, https://www.eia.gov/todayinenergy/detail.php?id=30052

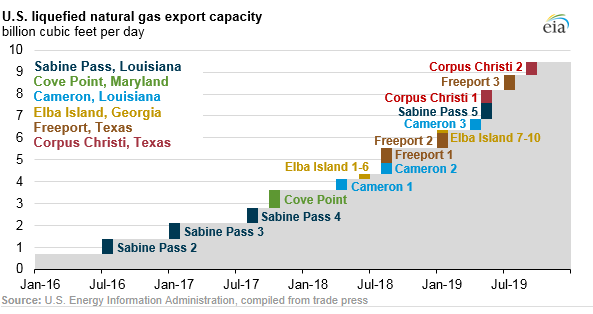

- Currently, there is only one active LNG export station, Sabine Pass, in Louisiana, the well-known Cheniere Energy Company. It is still planned to start operating another five new LNG export terminals/terminals by 2020. According to the US Energy Information Administration (USA), the USA will become the world’s third-largest LNG exporter by 2020 after Qatar and Australia, following the construction of the below terminals:

- Cove Point, Maryland Export LNG Terminal

- Cameron, Louisiana Export LNG Terminal

- Elba Island, Georgia Export LNG Terminal

- Freeport, Texas Export LNG Terminal

- Corpus Christi, Texas Export LNG Terminal

U.S Liquefied Natural Gas Export Capacity, Source: U.S Energy Information Administration (EIA), United States expected to become a net exporter of natural gas this year, https://www.eia.gov/todayinenergy/detail.php?id=32412

- Larger LNG importers by 2040 will be Europe and Asia, more specifically China and India are expected to cover the bulk of future demand for LNG. One of the basic principles which will govern the future foreign policy of China, India, and Europe will be energy security and the uninterrupted flow of energy goods, which will be largely geared to gas and, secondarily, to oil. In fact, one of the most important principles of US foreign policy over the last 70 years, was the uninterrupted flow of oil/energy to their country, will be adopted by all major energy importers by 2030. Already countries such as China, India, Japan and Great Britain have already or will receive new aircraft carriers in the coming years, which will not only be used to promote military power but also as a deterrent to other major powers/Countries from stopping/disrupt the global free flow of energy.

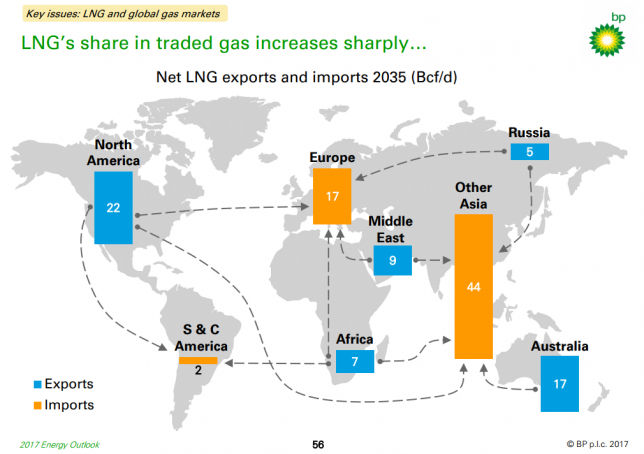

Net LNG Exports and Imports to 2035, Source: BP Energy Outlook 2017, https://www.bp.com/content/dam/bp/pdf/energy-economics/energy-outlook-2017/bp-energy-outlook-2017.pdf

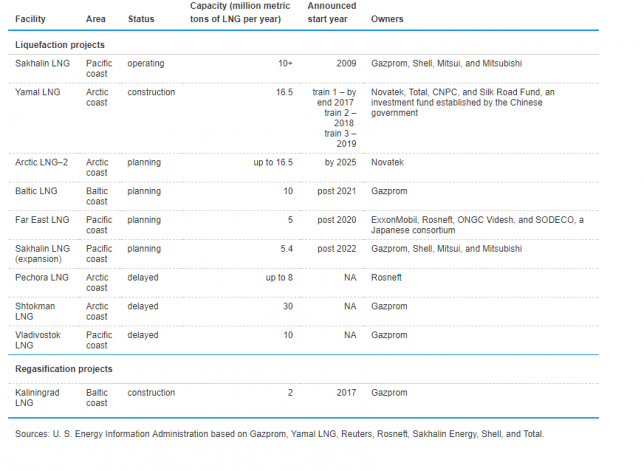

- Russia already participates in the global LNG market as an exporter, and its participation will increase in the coming years, which plays an important role in the Eurasian geopolitical chessboard. Also, Russia has announced several future LNG export terminals which expected to be built over the next fifteen years.

Russian future and under construction LNG Export Terminals, Source: U.S Energy Information Administration (EIA), Russia Country Energy Profile for 2017, https://www.eia.gov/beta/international/analysis.cfm?iso=RUS

- Replacement of coal/lignite by natural gas as the main fuel for global electricity generation will further boost global demand for gas and is an unpredictable factor that can also trigger global demand for LNG. This trend will also increase because the recent increase in LNG storage sites has been observed. The following storage tanks (see the below photo) will be placed in the future in power stations that use natural gas in all modern ports and train refueling stations as LNG will be used as a future fuel by modern trains and ships.

LNG Tank Storage Facilities, Source: http://www.mcc.com.cn/mccen/focus/_325423/338697/index.html

- Due to the large growth of the global LNG market, in the medium-term future, the trend is the global competition between Russia, Australia, the USA and Qatar for which country will prevail with a larger market share in the global LNG market.

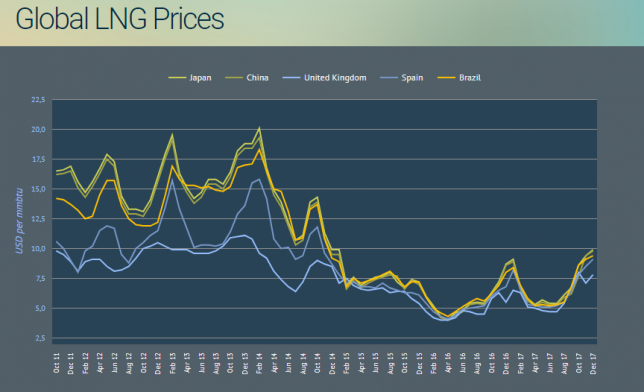

Global LNG Prices

Global LNG Prices October 2011-December 2017, Source: Bluegold Research, https://bluegoldresearch.com/global-lng-prices

As we can observe from the graph above, Global LNG prices have changed quite a lot in recent years. More specifically, from an average of $ 15-17 / MMBtu in October 2013, it dropped to an average of $ 7-10 / MMBtu in October 2017. Of course, global surveys and studies indicate that the forecast for World Liquefied Natural Gas Prices is optimistic for countries with large gas imports and pessimistic for countries with large gas exports.

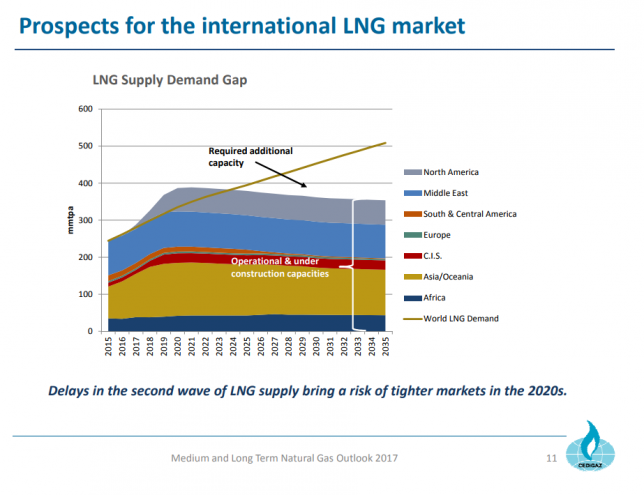

Predictions for the Global LNG Market. Source: Πηγή: Medium and Long-Term Natural Gas, Outlook 2017 Presentation (July 2017), Cedigaz, http://www.cedigaz.org/documents/2017/SummaryMLTOutlook2017.pdf

According to CEDIGAZ (the International Association for Natural Gas), oversupply to the global LNG market will last until 2023-2025, resulting in World LNG Prices to drop below 10 $ / MMBtu. At these prices, many LNG Export Terminals are either uncompetitive or have low-profit margins and, in some extreme cases, do not even cover their export costs. Also, CEDIGAZ is predicting that a supply shortage may occur after 2025, with the result that the current LNG Exporters cannot cover the future global demand for LNG, a situation that will trigger global LNG prices above 15 $ / MMBtu,. This situation may benefit future LNG exporters who plan to start exporting after 2025, these LNG exporting countries are:

- Cyprus

- Israel

- Mozambique, and

- Greece, partly if the country has the large gas reserves that the seismic surveys are indicating, especially south and southwest of Crete.

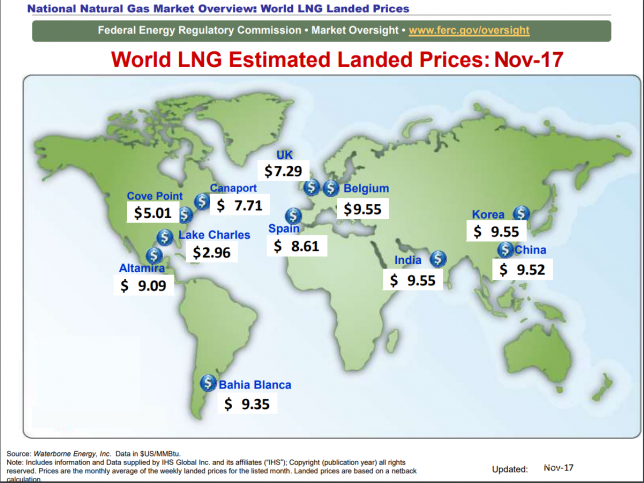

Global LNG Prices, November 2017, Source: https://www.ferc.gov/market-oversight/mkt-gas/overview/ngas-ovr-lng-wld-pr-est.pdf

As expected in the winter, LNG prices are rising due to higher gas demand for electricity generation and domestic heating caused by low temperatures. Developed economies that cover a large part of their energy needs with natural gas will pay higher prices than other countries. Such countries are Italy, Germany, South Korea and Japan. Finally, we should mention that the secret for the global LNG Industry is to increase demand by 2030 to balance the supply and demand markets.

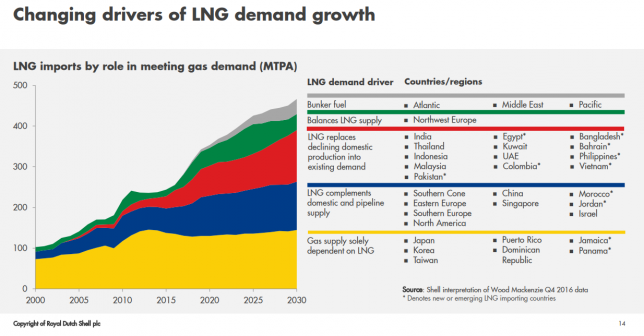

Future Global LNG Demand until 2030, Source: Shell, Presentation LNG Outlook 2017, http://www.shell.com/energy-and-innovation/natural-gas/liquefied-natural-gas-lng/lng-outlook/_jcr_content/par/textimage_1374226056.stream/1490189885482/516845c6c67687f21ff02bec2d330b97c91840f9ffa9e4348e7b875683215aaf/shell-lng-outlook2017-slides-master-march2017.pdf

Future global LNG demand will be derived/based on four categories that are:

- The use of LNG as fuel by ships by replacing oil in areas such as the Middle East, the Atlantic Ocean, and the Pacific.

- Replace the reduced domestic gas production with LNG imports for countries such as India, Northwest European countries, and

- To cover domestic gas demand with LNG imports but also to import from pipelines for countries such as Southern and Eastern European Countries, China and Jordan.

- Cover internal demand only by imports of LNG for countries such as South Korea, India, and Taiwan.

Finally, we can say that the following factors may affect future global LNG prices but also global LNG demand and supply, these are:

- Future exploitation of their domestic methane hydrate deposits at competitive mining prices to cover their domestic gas market for countries like India, China, Japan or even Greece.

- A future global recession due to the creation of a global bubble / artificial prosperity due to the oversupply of money from all the central banks of the planet.

- A future crisis/recession of the Chinese Economy due to a property bubble or stock market bubble

- A new energy breakthrough such as a new form of cheap energy or a rapid reduction in the cost of energy storage and renewable energy.

- An energy policy shift, like the closure of all Japan nuclear power plants following the Fukushima accident. At this point, we should point out that Japan plans to start re-energizing nuclear power stations by 2025, which will reduce the demand for LNG imports. Already by September 2017, Japan had begun production of 5 of the country’s 54 total stations, with four being destroyed in the Fukushima accident and the rest being inactive. 1

- The development of new liquefied natural gas exprort technologies, which will reduce the cost of export per $ / MMBtu and reduce the plant’s initial capital costs. These technologies are Small-Scale LNG and the Floating LNG Units (LNG)

FLNG, Floating LNG Unit, Source: https://www.lngworldnews.com/wp-content/uploads/2016/11/petronas-flng-satu-gets-first-gas.jpg

Conclusion

This analysis was a global snapshot/overview of the Global LNG Dynamics and Trends which are changing the last 6 years per quarter. Global Energy Companies which have LNG assets to their portfolio and Global Investors which have invested in LNG Assets need to monitor closely the Global LNG Market in Weekly and Monthly bases.

The Greek Version of this article was published by Foreign Affairs Magazine Hellenic Edition in their website on 25/01/2018, http://www.foreignaffairs.gr/articles/71614/athanasios-pitatzis/o-rolos-toy-lng-stin-eyropaiki-energeiaki-asfaleia?page=show

English Version URL: https://www.foreignaffairs.gr/articles/71733/athanasios-pitatzis/the-role-of-lng-in-european-energy-security?page=show

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Alternate Committee Member of the Greek Energy Forum. He specializes in the development of oil & gas and power markets in the UK and the Southeast Europe and the Mediterranean. Also, he is the owner of the website Energy Routes in which he publishes all of his articles for global energy industry, http://energyroutes.eu/ . He has published more than 50 energy opinion articles in major Greek and English Energy websites (in English: Natural Gas Europe, Europe Energy Review, OilVoice, International Petroleum Students Magazine, Resources Global Network Magazine, About Oil Magazine and Rigzone) Currently, is working as PV Performance and Monitoring Analyst in the UK. (His LinkedIn Profile: https://www.linkedin.com/in/thanospitatzis/ ).The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis.

References:

- By Ken Silverstein , Japan Circling Back To Nuclear Power After Fukushima Disaster, Forbes, 08/09/2017, https://www.forbes.com/sites/kensilverstein/2017/09/08/japan-may-be-coming-full-circle-after-its-fukushima-nuclear-energy-disaster/#13546df30e8c

- Medium and Long-Term Natural Gas, Outlook 2017 Presentation (July 2017), Cedigaz, http://www.cedigaz.org/documents/2017/SummaryMLTOutlook2017.pdf

Leave a comment