By Athanasios Pitatzis

This article it was republished by OilVoice on 22th of August of 2016, http://www.oilvoice.com/n/Monetization-options-for-emerging-and-future-gas-producers-LNGC-/c55032a786b0.aspx

The recent years many emerging gas producers are examining their options regarding the most beneficial monetization options or a combination of them for their vast gas reserves. Some emerging gas producers are Cyprus and Israel (already produces gas from the Tamar gas field), Myanmar in South East Asia and Mozambique in East Africa. One other category of future gas producers in East Mediterranean can be Lebanon and Greece. In this globally competitive environment in which the economic problems are expanding rapidly, emerging and future gas producers are facing challenges regarding the best monetization option for their gas reserves. Most of the known technological available monetization natural gas options until the given date are:

- Oil Field Injections

- Liquid Fuels

- Power Generation

- Exports via pipeline

- Exports via LNG

- Exports via CNG

- Petrochemicals

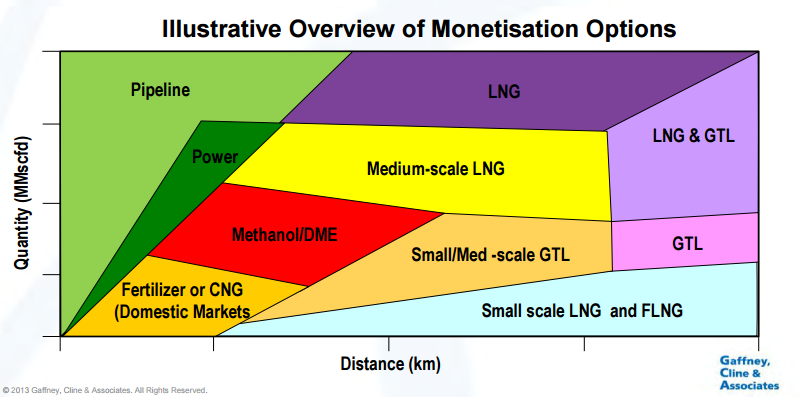

According to the Gaffney, Cline & Associates (GCA), criteria for determining the appropriate gas monetization option is based on many factors, some key development options being:

- Size and quality of the gas resource

- Location of the resource relative to key markets – local and export

- Competitiveness of end products

Illustrative Overview of Monetization Options, Source: Gaffney, Cline & Associates (GCA) Company Presentation, http://www.gaffney-cline.com/downloads/royal_institution_september_2013/Infrastructure%20and%20Gas%20Monetisation.pdf

The LNG Exports is not an option for the next decade

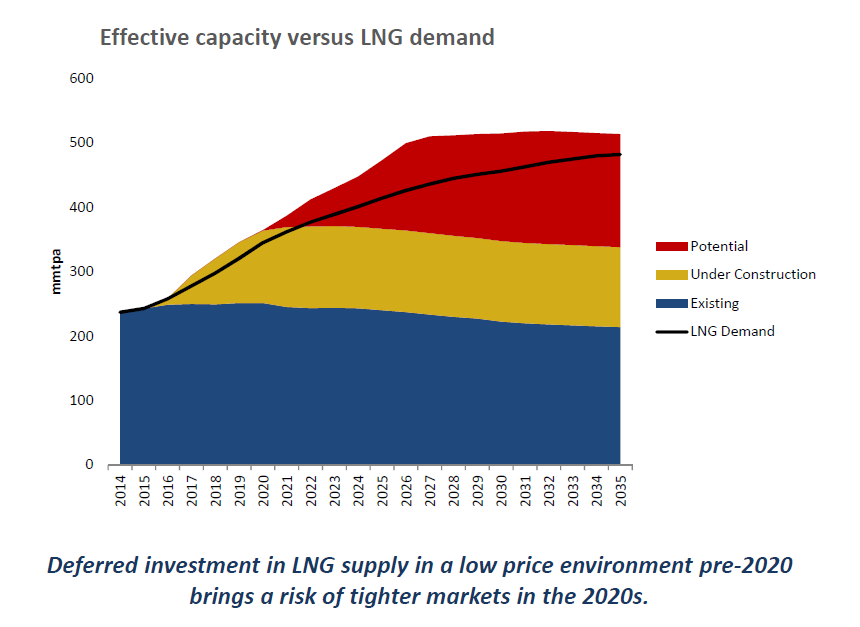

Global LNG market will be massively oversupplied until 2025 at least, so probably global LNG prices will remain below $10/mmbtu. New LNG export terminals will struggle to get Final Investment Decision and financial support from banks and international organizations due to low global LNG prices and to future anemic global LNG demand. This complicated current and future LNG market conditions are demonstrated very well in the upcoming chart by Cedigaz, the international association of natural gas.

Prospects for the international LNG market, Source: Medium and Long Term Natural Gas Outlook 2016 Presentation, Cedigaz, http://www.cedigaz.org/resources/free-downloads.aspx

Based on the above graph, it is evident that:

- Many future planning LNG export terminals will not be constructed

- Global LNG demand is expected to rebalance the Global LNG Market after 2022 and beyond

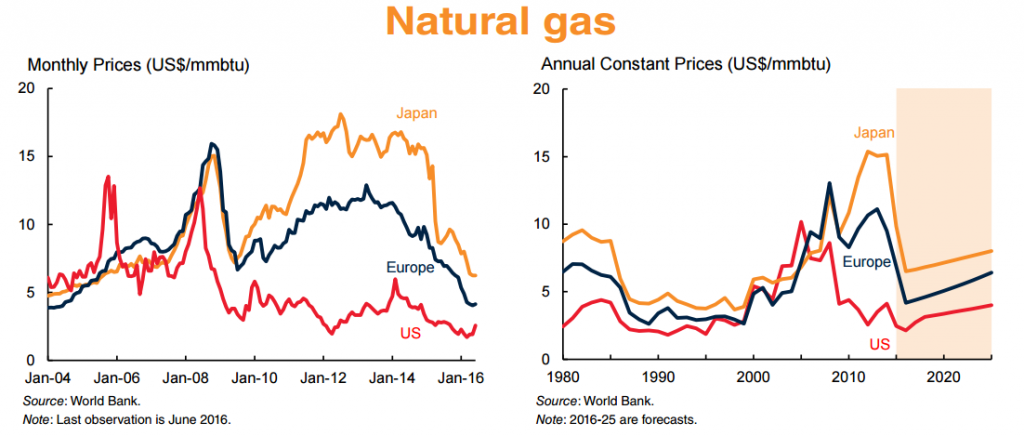

Moreover, one recent report by World Bank predicts that natural gas price between 2015 and 2025 will be:

- In Europe, $4.50/mmbtu until $8.00/mmbtu with an increasing trend through the decade

- In the USA $2.3/mmbtu until $5.00/mmbtu with an increasing trend through the decade

- In Japan $7.00/mmbtu until $10.00/mmbtu with an increasing trend through the decade

Natural Gas Current and Future prices until 2025 in Europe, US and Japan, Source: Commodity Markets Outlook, July 2016: From Energy Prices to Food Prices Report, World Bank, https://openknowledge.worldbank.org/handle/10986/24735

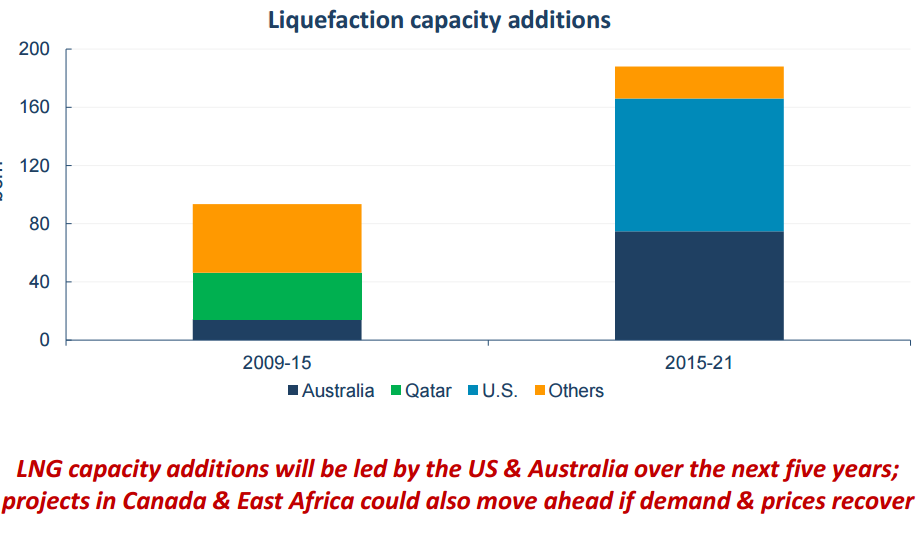

Based on the report IEA Medium-Term Gas Market Report 2016, USA and Australia will dominate the new Liquefaction capacity additions until 2021, observe the graph below.

Liquefaction capacity additions until 2021, Source: Medium-Term Gas Market Report 2016 (Short Presentation), International Energy Agency, https://www.iea.org/newsroomandevents/speeches/160608_MTGMR2016_presentation.pdf

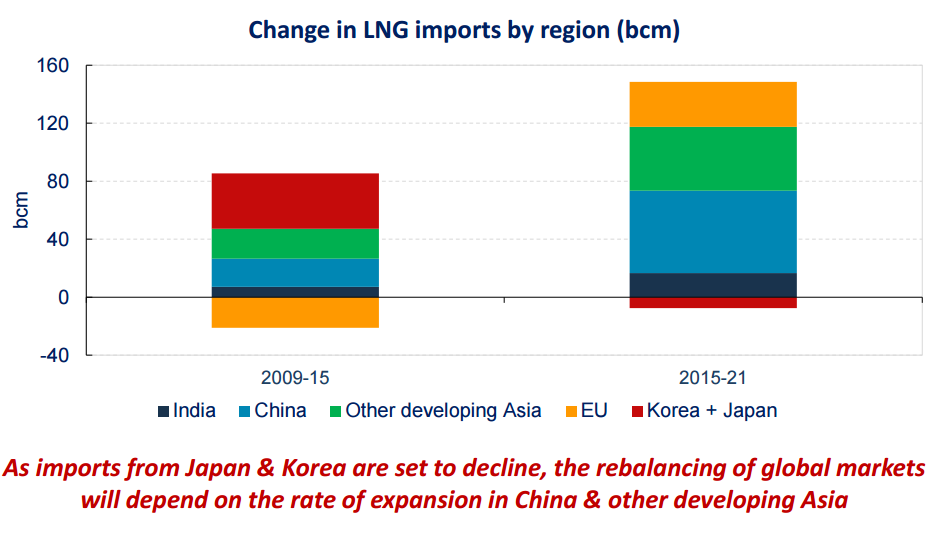

Also, based on the same report from International Energy Agency, EU, China, and Asia developing countries will drive the changes in LNG global imports for the next six years until 2021. (Observe the graph below)

Changes in LNG imports by region (bcm), Source: Medium-Term Gas Market Report 2016 (Short Presentation), International Energy Agency, https://www.iea.org/newsroomandevents/speeches/160608_MTGMR2016_presentation.pdf

Current and future LNG exporters must be aware that global LNG contracts are shifting from long-term and oil-linked contracts to short – term and gas on gas contracts.

Oil-Linked pricing is losing ground since 2009, Source: Impact of the Oil Price – How Long Will This New Pricing World Continue? Presentation, Cedigaz, http://www.cedigaz.org/resources/free-downloads.aspx

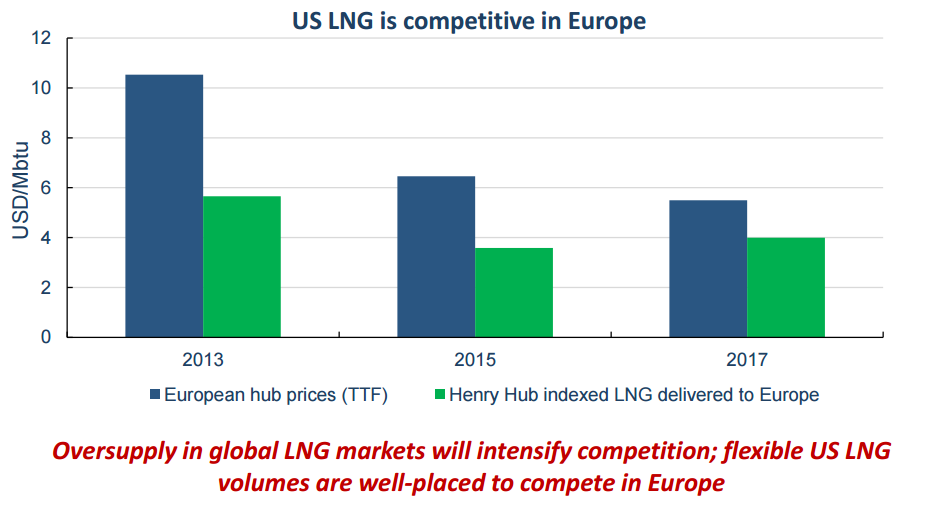

According to Cedigaz, LNG import contracts which are oil-linked account for the 74% of the global LNG import contracts and the remaining 26% are gas on gas contracts. Due to global LNG glut, we believe that a big share of the future LNG import contracts and especially after 2020 will be gas on gas. Finally, current and future LNG exporters must be competitive if they want to enter the Global LNG Market, for example, US LNG exports are very competitive. (Observe the graph below)

US LNG is competitive in Europe, Source: Medium-Term Gas Market Report 2016 (Short Presentation), International Energy Agency, https://www.iea.org/newsroomandevents/speeches/160608_MTGMR2016_presentation.pdf

CNG and Downstream Options

Based on all of the above information and outcomes, current and future gas producers/possible exporters if the gas reserves are large enough have three more monetization options for their gas resources, these are:

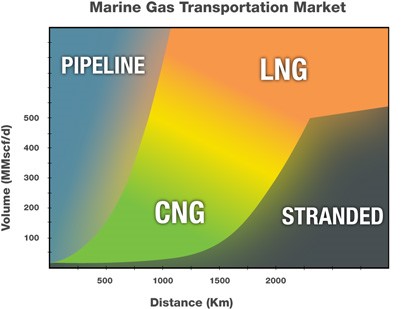

- Explore other export options for gas such as CNG exports. Sea NG claims that the Coselle™ System is an ideal solution for monetizing smaller volumes of gas because it enables access to regional markets. Specifically, the Coselle™ System is often the most economical solution for moving volumes up to 500 MMscf/d over distances up to 2000 km – the Coselle™ “market focus”. Also, CNG can be used as a marine fuel instead of LNG if this is more profitable. This technology can be utilized from current and future gas exporters for access to local markets. These local markets can be North Sea, South – East Asia, Middle East, South-East and West Mediterranean and Central America.

Marine Gas Transportation Market, Source: Sea NG, http://www.coselle.com/applications/overview

- Many current and future gas producers will benefit if expand their local gas market through different downstream options. Some of these downstream options can be the promotion of gas as a transportation fuel (LNG or CNG vehicles), gas power generation plants or a Petrochemical factory.

Cooperation between LNG exporters and importers

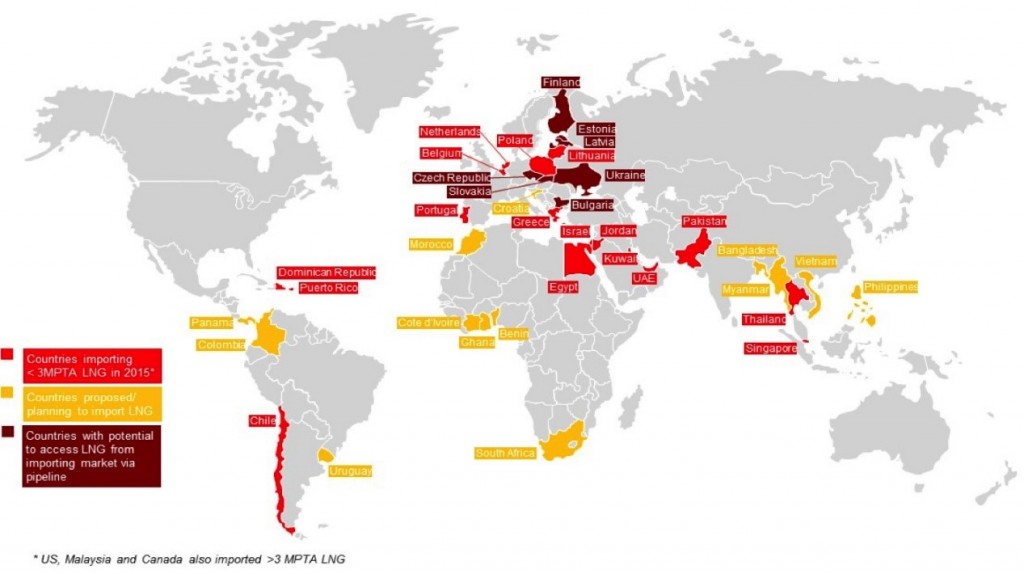

Global oil and gas companies which are shareholders on large LNG export terminals should cooperate with their current and future LNG importers with the primary target to increase global LNG demand so that the market can rebalance more quickly, and LNG prices start rising again. This cooperation can be implemented in many ways, these are:

- Promoting the use of floating regasification terminals (FSRU) by LNG importers

- Promoting LNG as a marine fuel

- Developing small target markets for LNG imports (observe the map below)

Growing ‘tail’ of LNG sales: Smaller markets importing less than 3 MPTA, Sources: The International Gas Union, World LNG Report 2016 © 2016 IGU, Accenture Research, https://www.accenture.com/us-en/blogs/blogs-expand-global-lng-demand-think-small

Conclusion

The full monetization of their gas reserves by the current and future gas produces will be a difficult task through the upcoming decade. Their focus should be to expand their domestic gas market, target to export gas to the local market/countries and to reduce costs so that they can be competitive in the global gas market.

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Member of the Greek Energy Forum. He specializes in the development of oil & gas markets in Southeast Europe and the Mediterranean. Also, he is the owner of the website Energy Routes in which he publishes all of his articles for global oil and gas industry, http://energyroutes.eu/ The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis.

Someone essentially help to make significantly

articles I’d state. This is the first time I frequented your website page and so far?

I surprised with the analysis you made to make this

actual publish extraordinary. Great task!