Methane Hydrates: A Business opportunity for NOCs in the Middle East and large IOCs?

By Athanasios Pitatzis

In today’s article we will cover the possibility that Methane Hydrates can become a business opportunity for the National Oil Companies (NOCs) in the Middle East or the large integrated oil companies like Exxon Mobil.

Methane Hydrates

According to the World Ocean Review and their report “Marine Resources – Opportunities and Risks” the existence of methane hydrates has been known since the 1930s but only in the last 10 years has it become a subject of serious consideration as a possible source of energy from fossil fuels for the future. It is now possible to calculate the total amounts available with some confidence.

Also, this report mentions that Methane hydrate is formed when water and methane gas are combined at temperatures below 10 degrees Celsius and pressures greater than 30 bar, or 30 times normal atmospheric pressure. Methane is surrounded by water molecules and trapped in a molecular cage. Chemists therefore call this kind of molecular structure a clathrate (lat. clatratus = with bars, caged)

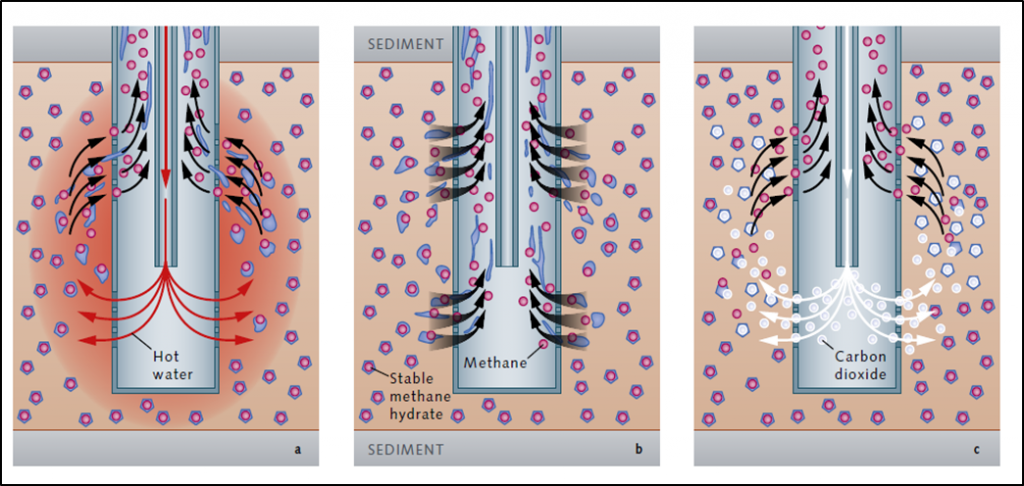

The methods to extract them are three:

Flooding with water requires immense amounts of energy, which makes it uneconomical.

With depressurization and

The injection method with CO2

Methods of extraction of Methane Hydrates, Source of the photo: Resources, M. (2014). World ocean review.http://worldoceanreview.com/ ,

Japan: The first country which produced natural gas from methane hydrates

Japan’s national company of “Japan Oil, Gas and Metals National Corporation (JOGMEC) in cooperation with a consortium of companies conducted the first flow test from the offshore methane hydrates reserves off the coasts of the Atsumi and Shima peninsulas. This test took place from the 12th until the 18th of March 2013.

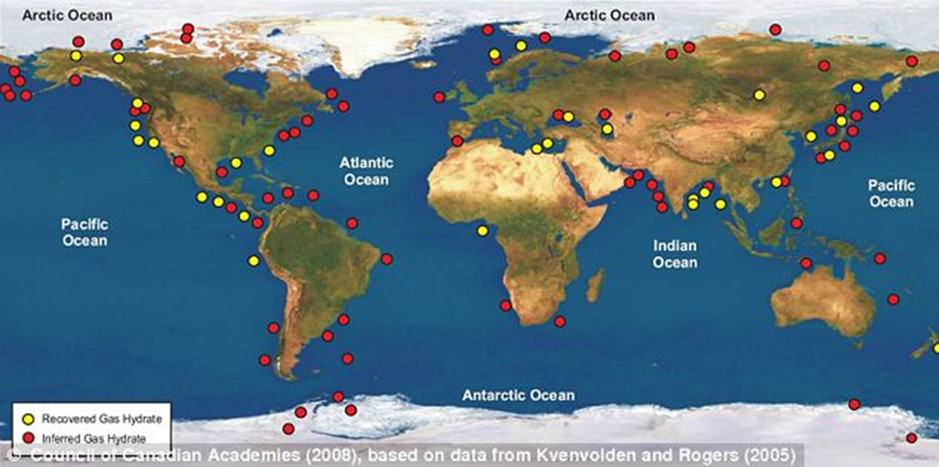

Hydrate Global Reserves

According to the experts of this sector Methane Hydrates Reserves have been estimated to be about 21,000 trillion cubic meters, about 100 times the total natural gas reserves currently worldwide. They content that even if 10% of these quantities is technically recoverable it can be used for many centuries. We must take into consideration also that these quantities must be also commercial so we can exploit them and this depends on the prices and the demand for natural gas globally.

Methane Hydrates Reserves, Source: http://www.dailymail.co.uk/sciencetech/article-2292555/Japanese-breakthrough-country-extract-fuel-ice-reserves-locked-beneath-coast.html#ixzz2NSgeQfQe (published: 09:27 GMT, 13 March 2013)

Rating for the reserves cannot be done safely because this is a new form of energy. However, experts claim that our planet contains large quantities of methane hydrates.

Baker Hughes participation on the extraction of Methane Hydrates in Japan

A 19 April 2013 Baker Hughes post notes “Baker Hughes provided the completion system for the test well, which was drilled in approximately 1000 m of water into a hydrate formation approximately 300 m below the mud line.” This indicates that the company acquired the know – how for this procedure, so a strategic cooperation with this company may offer access to this unique data.

SWOT Analysis of the extraction of Methane Hydrates

Strengths

- Can be found at very low depths (location)

- Enormous Reserves (observe above Methane Hydrates reserves)

- Quality of gas trapped in clatherates

- Geographical diversification of the reserves, observe the map above

- Potential future energy source

Weakness

- Extract the methane hydrates and economically transport it, it is a technological challenge

- Difficult discoveries of significant / commercial reserves

- No commercial extraction process for methane hydrates until now

Opportunities

- Available commercial extraction technology for methane hydrates in the near future, due to the latest discoveries in Japan

- Diversification of company portfolios which will focus business activities in this unconventional energy source

Threats

- Future environmental hazard, due to the large amount of natural gas from hydrates can be released in the atmosphere

Proposed Strategies for NOCs of Middle East for Methane Hydrate Industry

- Buy or merge with Baker Hughes (Halliburton now), because they probably possess the extraction technology of methane hydrates. (observe above statement about Baker Hughes)

- Invest a lot of money to expand the knowledge and technological capabilities for methane hydrates exploration and refinery process.

- Become the first operator in methane hydrate industry

- Strategic alliance with JOGMEC, propose to the Japanese government new investments in the Japanese exclusive economic zone for exploration of methane hydrates with major objective the energy security of Japan.

- Due to the global estimated methane hydrate reserves if one of the NOCs like Saudi Aramco enters the industry first may become the biggest oil and gas operator globally.

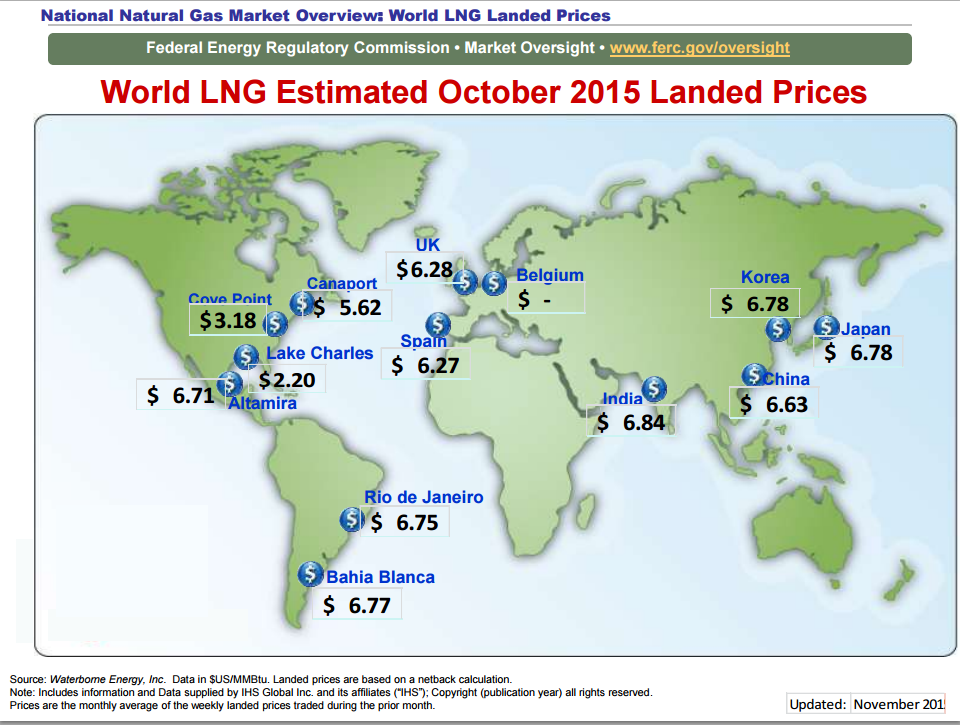

Cost of Extraction of Methane Hydrates

According to Oil and Gas financial journal in the article “Challenges of the Methane Hydrates” by Darren Spalding and Laura Fox, Bracewell & Giuliani LLP, London on May 7, 2014 the cost of developing any new energy is high and methane hydrates are no different. The current cost of gas produced from methane hydrates is estimated to be US$30 to US$50 per million British thermal units (MMBTUs). The International Energy Agency estimates that once efficient practices and processes are developed, natural gas produced from methane hydrates will cost between US$4.70 and US$8.60 per MMBTU.

Source: https://www.ferc.gov/market-oversight/mkt-gas/overview/ngas-ovr-lng-wld-pr-est.pdf

It is obvious from the above data that the extraction of Methane Hydrates is a risky and expensive process and with the recent prices of LNG is unprofitable to extract them. However, a solution to this problem maybe the use of CNG technology. If CNG marine technology is used then it is cheaper to transfer natural gas up to 2500 km from the producing well.

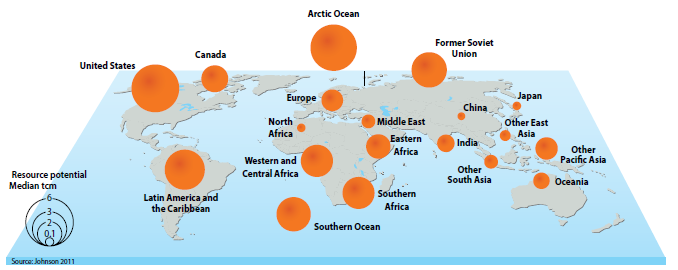

Gas hydrates resource potential by global regions

Gas hydrates resource potential by global regions. This figure includes only that subset of global in-place gas hydrates that appear to occur at high concentrations in sand-rich reservoirs, the most likely candidates for development. Source: Johnson 2011. Source: Beaudoin, Y. C., Dallimore, S. R., and Boswell, R. (eds), 2014. Frozen Heat: A UNEP Global Outlook on Methane Gas Hydrates. Volume 2. United Nations,Environment Programme, GRID-Arendal..© United Nations Environment Programme, 2014, ISBN: 978-92-807-3319-8

The above graph suggests that the potential business strategy of the NOCs but also and IOCs of Middle East for the future exploration of Methane Hydrates will be to focus on this specific regions:

- Eastern Africa

- Southern Africa

- Western and Central Africa

- Southern Ocean and maybe

- Latin America and the Caribbean

The geopolitical footprint of methane hydrates

If over the next 10 years and by 2020 the hydrates methane extraction technology becomes commercially exploitable and extraction costs viable, geopolitical changes will be tectonic, including:

- Total independence of Japan from imports of natural gas, partly perhaps the independence of China as well.

- Gradual crowding from countries which produce conventional forms of hydrocarbons such as Saudi Arabia and Qatar, but not Russia, which has several possible areas with existing deposits of methane hydrates.

- Future supply of the European Union’s natural gas production from methane hydrates from the Black Sea and the Southeast Mediterranean.

- Increase of the geopolitical importance of the following areas due to the presence of methane hydrates: Southeastern Mediterranean, Southeast Asia, the Black Sea, Caspian Sea, North Sea, Latin America, North America and of course the seas around India which appear to contain large amounts of methane hydrates.

Finally we would like to mention that the journey is now starting to look exciting so fasten your seat belts, the story of methane hydrates has now started and can change life on our planet as we know it today.

Conclusion

The managers of the NOCs of the Middle East may want to evaluate the following facts:

- Until 2030 or 2040 it is estimated that the oil reserves of the Middle East will decrease

- The main future consumers of oil and gas industry is South East Asia countries like China and Japan

- This century is the gold century of natural gas

- NOCs of the Middle East possess the cash flow to diversify their business portfolio, taking advantage of that and invest to unconventional energy sources, like Methane Hydrates.

The same business strategy applies also for the large integrated oil companies like Exxon Mobil and Chevron. Also this strategy will be a beneficial fit for major European oil and gas companies like BP, Total and Eni because they operate already in many areas which exist large quantities of Methane Hydrate potential reserves like south east Mediterranean, Eastern and Western Africa. In a period of low oil and gas price which company will take a step ahead to become the future leader of our industry?

“Michel Collon a Belgian writer, journalist, and historian claims that if you want to control the world, you must control the oil, all the oil everywhere in this planet.”

My estimation for the period after 2020 is that the geopolitical trend-message which could dominate the thought process of the policy makers worldwide will be:

“If you want to control the world, you must control the methane hydrate deposits, all the methane hydrates deposits everywhere in this planet.”

Finally a reminder of my general message through this article:

The best way to predict the future is to create it. Abraham Lincoln

Athanasios Pitatzis is Member of the Greek Energy Forum. The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis

Athanasios Pitatzis is also owner of the website Energy Routes in which he publish all of his articles for global oil and gas industry, http://energyroutes.eu/

It was first published on Oilfield Magazine website on 20th of November 2015, http://oilfieldmagazine.com/methane-hydrates-a-business-opportunity-for-nocs-in-the-middle-east-and-large-iocs/

Leave a comment