By Athanasios Pitatzis

The European Union has set a goal to become a fully integrated energy market in the upcoming years. For that reason, European Commission has launched a new program which it’s called European Energy Union. The main characteristics of the Energy Union according to the European Commission are:

- Energy security, solidarity, and trust

- Research, innovation, and competitiveness

- Transition to a low-carbon society

- A fully integrated internal EU-wide energy market

- Energy efficiency as an energy source in its own right

The final outcome of the European Energy Union is to promote competitiveness, solidarity, and security among its members.

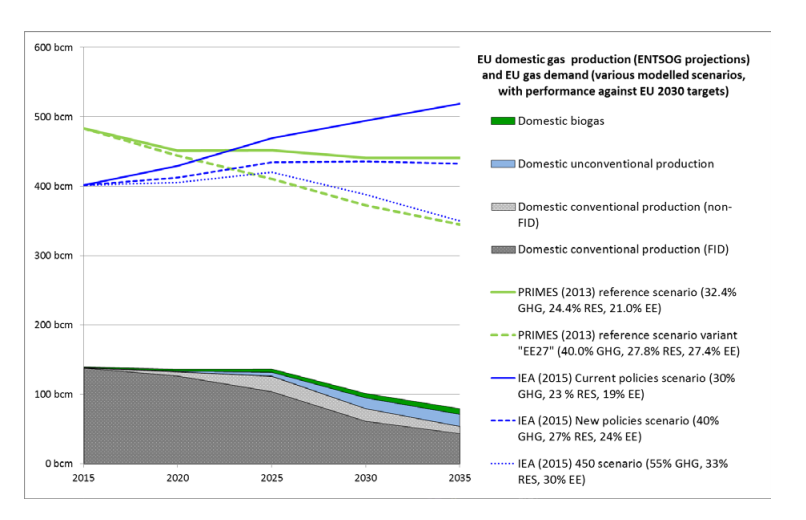

Future European gas domestic production and Consumption

Future EU domestic gas production and EU gas demand, Source: European Commission Report for EU strategy for liquefied natural gas and gas storage,http://ec.europa.eu/index_en.htm

Based on the above graph it is obvious that the future European gas market trends are:

- EU domestic gas production will decline the upcoming years and especially after 2025

- EU gas demand will increase or decrease according to many factors that affect it. The main factors which will affect future European gas demand are the choices made by Member States and energy companies, carbon prices, future technology costs and of course the global fossil – fuels prices.

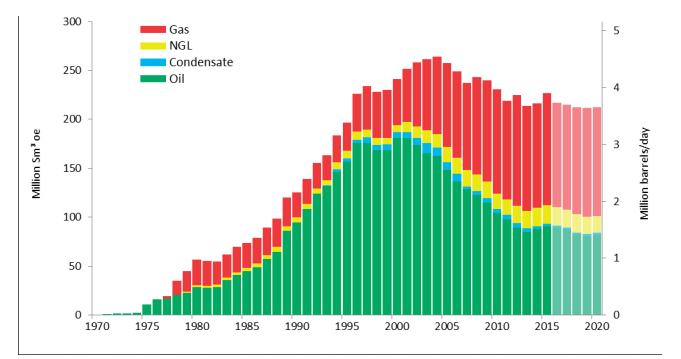

Norway current and future gas production

One of the key elements of European gas security is the level of imported gas from Norway. Norway is a reliable source for gas the last decades for Europe and its geographic location and strategic huge gas reserves make that possible. In 2013 according to Cedigaz (the international association of natural gas) Norway has exported 107 billion cubic meters of natural gas to Europe which represent the 21% of total European gas demand for this year.

Actual and forecast sales of petroleum 1971-2020, Source: Norwegian Petroleum Directorate, http://arcticjournal.com/sites/default/files/the-shelf-in-2015-press-release.pdf

Based on the above graph Norway gas production will be stable until 2020 but from 2020 and beyond many experts claim that the production will decline significantly, so Europe will have to cover this gap in imported gas from Norway from other sources such as LNG imports or to increase underground gas storage capacity. Finally, to mention that it is possible that Norway to find new gas fields and the whole situation to change significantly. For instance, after the new discovery of Zohr giant gas field in Egypt, this country increased its proven gas reserves by 30% only with one field. Zohr gas field is estimated to possess 30 trillion cubic feet of gas proven reserves (roughly to 800 – 900 billion cubic meters of gas).

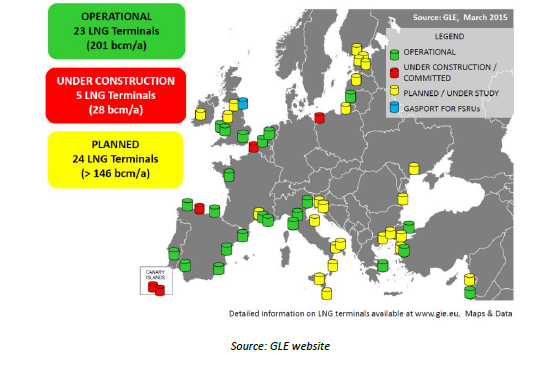

Europe LNG Strategy

LNG imports will play a vital role in the future European energy mix. According to the recent Council of European Energy Regulators (CEER) Analysis “On the role of LNG to improve Security of Supply” Europe has 23 operational LNG import terminals with total import gas capacity of 201 bcm/year. Moreover, 5 terminals are under construction and 24 terminals are planned for construction in the future.

Also, the same report from CEER mentions that the LNG terminal utilization in Europe is very low and it’s in decline from the 53% on 2010 to 19% on 2014. The main factors which have forced this trend are:

- Stable European Gas Demand

- High LNG prices between 2010 and 2014 in comparison with European gas hub prices

- High levels of underground gas storage

Existing and planned LNG terminals in Europe, Source: Council of European Energy Regulators (CEER) Analysis “On the role of LNG to improve Security of Supply”, February 2016, http://www.ceer.eu/portal/page/portal/EER_HOME

It is obvious, from the above graph that the majority of LNG import terminals are in the Western Europe, so South – East European countries have no access to LNG import gas quantities. The future goal of the EU is to promote the construction of more LNG terminals in South East Europe (Italy, Greece, and Western Balkans) and in Baltic countries. The main factors which will affect the future European LNG demand are:

- Increasing gas import needs

- Decreasing in domestic gas production, especially in Netherlands due to the decreasing gas production of Groningen gas field (concern of the local population for earthquakes)

- Switch from coal to gas for electricity

- Natural gas will be used in the future to back up the renewables

Europe can benefit from the recent low LNG prices which will remain low for the upcoming years and especially until 2020. European gas companies can import cheap LNG to increase their gas storage, to increase gas liquidity to the whole European gas market and to promote gas as a transport fuel.

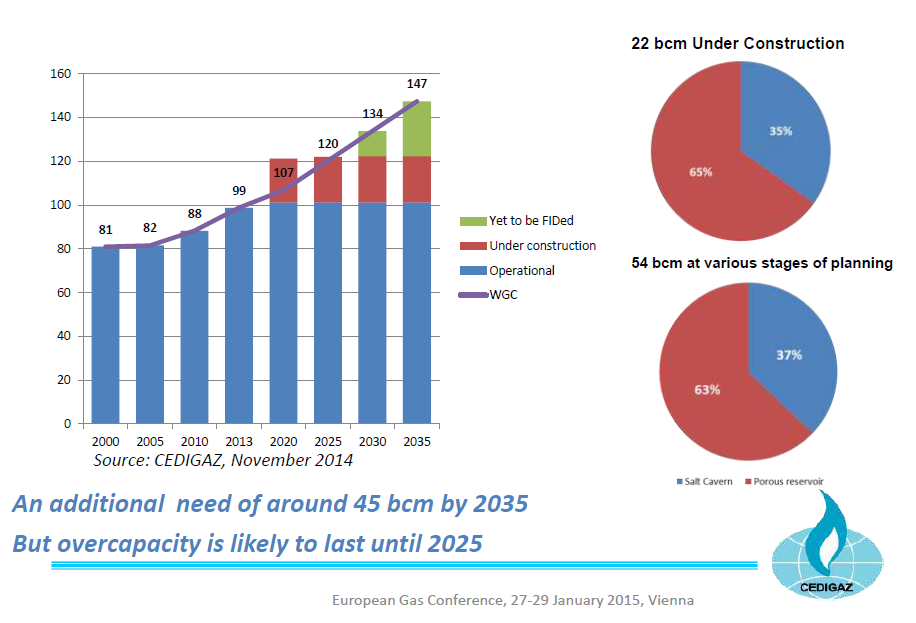

European Gas Storage

The biggest gas storage facilities in Europe are located in Germany (24.6 bcm), Italy (16.6 bcm), Netherlands (12.9 bcm), France (12 bcm), Austria (8.3 bcm), Hungary (6.3 bcm) and UK (5 bcm). According to the below graph, Cedigaz estimates that European UGS capacity will increase by around 45 bcm by 2035.

Estimates of European UGS (Underground Gas Storage) Needs by 2035, Source: Cedigaz Presentation, European Gas Conference, January 2015, Vienna,http://www.cedigaz.org/

European UGS will play a vital role in the future European plans regarding the security of supply for gas. The environmental constraints on coal, the supply and demand equation and the European gas market liberalization will drive the new era of growth for underground gas storage facilities in Europe for the next two decades.

Diversification of gas sources, a new strategy from Europe

Europe the last 10 years has increased its efforts to diversify its gas sources. The most promising new gas sources for Europe in the short and medium – term future are:

- USA LNG exports

- Southern Gas Corridor which will transfer gas from Azerbaijan to Europe. In the future, through this route, it is possible Iran and Turkmenistan to export gas to Europe

- East Mediterranean new gas discoveries

- East Africa LNG exports

- LNG imports from other suppliers such as Qatar or Australia

USA LNG Exports, a superpower energy player is rising again

The International Energy Agency estimates that most of the US LNG export terminals will be online until 2020, which will make the United States the world’s third-largest LNG exporter, behind Australia and Qatar. Can the US LNG exports can compete with Russian gas prices over Europe?

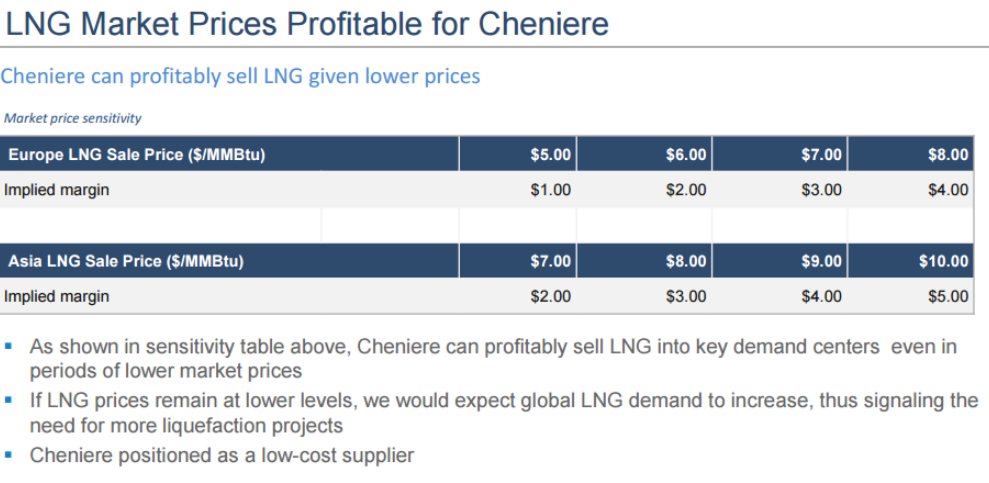

LNG Market Prices Profitable for Cheniere, Source: Cheniere Energy, http://www.cheniere.com/

It is obvious from the above graph that USA LNG exports can be very competitive even with LNG prices at 5$/MMBtu. Also, many experts claim that a gas price war between USA gas companies and Gazprom over Europe gas market is inevitable in the near future. Gazprom probably will adopt a strategy which will force the company to low gas prices over Europe (one of the lowest cost suppliers to Europe with spare capacity) with the main purpose to protect its market share over European gas market. The balance between political and commercial aspects will determine if USA gas exports will direct to Europe or Asia – Pacific region.

Conclusion

The main factors which can challenge the supply with gas for Europe are:

- Geopolitical tensions over the Middle East (Iran vs Saudi Arabia)

- Unstable countries such as Libya and Syria

- Future international relationships of Europe with Russia over Ukraine, Baltic Countries, Caspian Region and Turkey

- Global Oil and Gas prices

- High levels of debts in some European countries

Athanasios Pitatzis is is an Industrial/Petroleum Engineer and Member of the Greek Energy Forum. He specializes in the development of oil & gas markets in Southeast Europe and the Mediterranean. Also, he is also the owner of the website Energy Routes in which he publishes all of his articles for global oil and gas industry, http://energyroutes.eu/ The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis

This article was published first on Resource Global Network Magazine July 2016 edition.(pp 62-69)

http://resourceglobalnetwork.com/images/magazines/v3i4b/#p=68

Leave a comment