By Athanasios Pitatzis

It was first on OilVoice at 9th of May 2016, http://www.oilvoice.com/n/PEST-Analysis-for-global-oil-and-gas-companies-operations/07720ffeec07.aspx

The evaluation of PEST Analysis involves the Political, the Economic, the Social – Culture and the Technological environment in which an oil and gas company operates.

Political Factors

The threats for the business of oil and gas companies which are influenced by political factor and decisions are many, the main of them are:

- Geopolitical conflicts.

- Political Instability

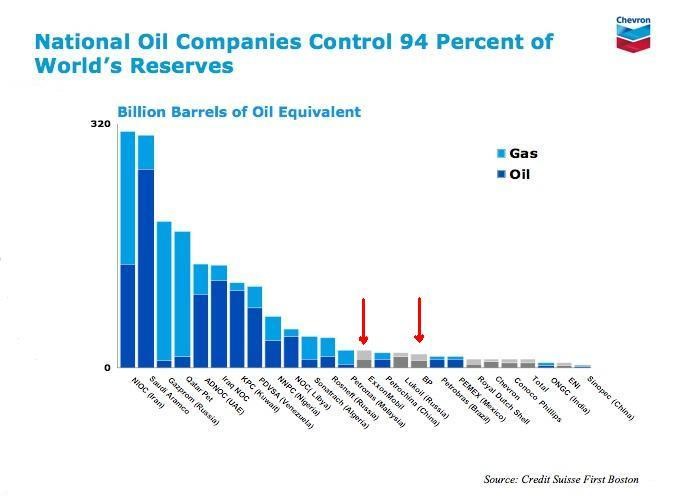

- The majority of the governments of the oil producing countries through their National Oil Companies control more than 90% of the proven oil reserves and over 75% of global oil and gas production.

National Oil Companies and World Oil Reserves, By JHEverson Consulting,15/02/2016, Source of the photo: http://www.jheversonconsulting.com/blog/2011/07/20/national-oil-companies-control-94-percent-of-the-world%E2%80%99s-oil-reserves-2/

- The presence of the significant amount of oil and gas reserves in a country can begin civil wars, and increase corruption. These side effects are known to the world as “resource curse.” All of the above, it is obvious that are barriers for foreign oil and gas companies to invest in these countries.

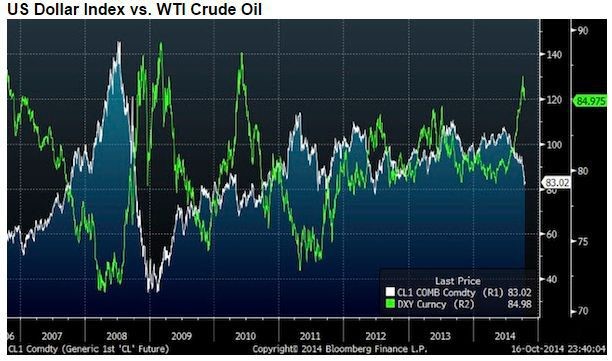

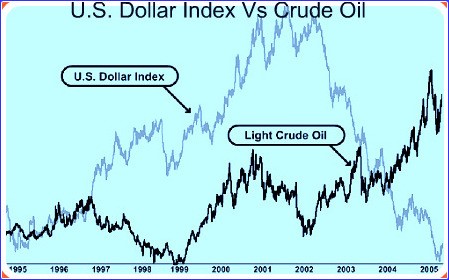

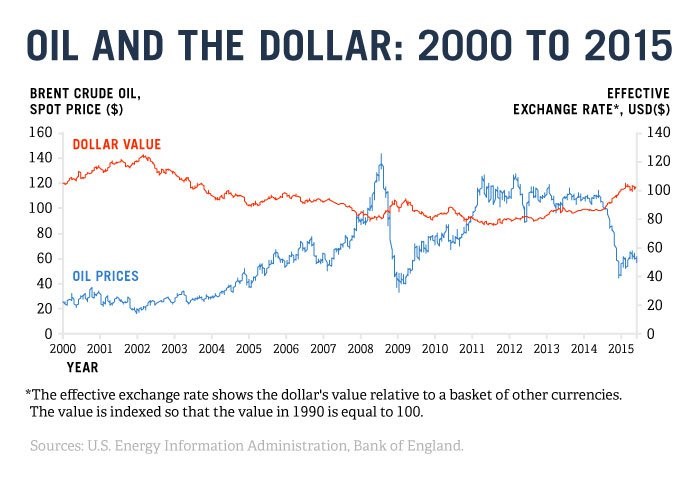

The complicated relationship between the value of US dollar and oil prices. When the dollar strengthens against other major currencies, the prices of commodities typically drop. Also, because the “political” decisions of a central bank affect the value of currency we conclude that the decisions of the central bank of USA (FED) can influence the value of the dollar and indirectly the oil prices. Observe the graphs below:

US Dollar Index vs WTI Crude Oil, Bloomberg,15/02/2016 Source of the photo: https://brianlangis.wordpress.com/2014/10/27/relationship-between-the-us-dollar-and-oil-prices/

According to Investopedia crude oil is quoted in U.S. dollars (USD) so that each uptick and downtick generates immediate realignment between the greenback and numerous forex crosses. These movements are less correlated in nations without significant crude oil reserves, like Japan, and more correlated in countries that have large reserves, like Canada, Russia, and Brazil. [1]

Oil price and the USA Dollar Value, By The Alert Investor, 15/02/2016, Source of the chart: https://www.thealertinvestor.com/oil-and-the-dollar/

OPEC

According to the formal website of OPEC, this the mission of the Organization of the Petroleum Exporting Countries (OPEC) is to coordinate and unify the petroleum policies of its Member Countries and ensure the stabilization of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for those investing in the oil industry. OPEC political decisions can affect dramatically international oil and gas companies. For instance, this organization can:

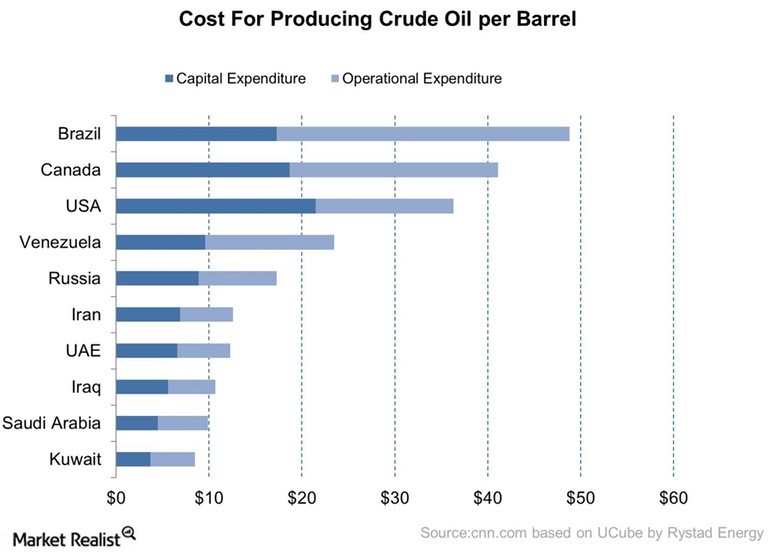

- Increase oil production so can drive oil price down with a result to maintain its global market share in the oil market due to the uneconomical production of oil from expensive oil producers (Oil Sands and Deepwater oil reservoirs). This strategy has taken place from 2014 until the given date.

- Decrease oil production so the oil prices can increase.

- Manipulation of the oil market.

The members of OPEC are Iran, Iraq, Kuwait, Saudi Arabia, Venezuela, Qatar, Indonesia, Libya, United Arab Emirates, Algeria, Nigeria, Ecuador, Angola, and Gabon. Even to this organization its members most of the times have different geopolitical, economic interests. For instance, as the given date:

- Iran and Saudi Arabia competing over the rule of the Persian Gulf and the Middle East.

Venezuela and Nigeria need a high oil price due to severe economic conditions (dependence on oil exports revenues). On the other hand, Saudi Arabia, UAE, Qatar and Kuwait need a low oil price so they can protect their market share in the global oil market.

How Long Can the Price War Continue in Crude Oil, By Robert Scott, 15/02/2016, Source of the chart: http://marketrealist.com/2015/12/long-can-price-war-continue-crude-oil/

GEFC

A similar global organization to OPEC is GEFC (Gas Exporting Countries Forum). The members of this forum are Algeria, Bolivia, Egypt, Equatorial Guinea, Iran, Libya, Nigeria, Qatar, Russia, Trinidad and Tobago, United Arab Emirates and Venezuela. Azerbaijan, Iraq, Kazakhstan, the Netherlands, and Norway. Also, to mention that Oman and Peru have the status of Observer Members. This organization controls the 67% of the world proven natural gas reserves. The increasing role of the natural gas in the global energy mix give to this forum a future significant role/value to the politics of the global natural gas market.

New Environmental and Taxes Policies

Each government has the legal right to change the national taxes for oil and gas industry profits. If the government increases these specific taxes, then oil and gas companies can face many problems such as decreasing profits, the uneconomic feasibility of expensive oil and gas projects and significant implications in their future corporate strategic and economic planning. Finally to mention that the recent global environmental trends for decreasing CO2 emissions, reducing the use of fossil fuels in the global energy mix and increasing of renewables sources of energy in the global energy mix can shape up the whole global oil and gas industry.

Economic Factors

The connection between petroleum industry and the global economy is significantly important and for that reason are heavily interact each other. It is known that global economic growth drives the global consumption of oil and gas. Also, to mention that oil price is firmly connected with oil supply and demand as every commodity nowadays. Besides, oil and gas industry must be concerned for the below economic factors that can affect the global economy, these are:

- Global Economic crisis.

- The bankruptcy of the large commercial banks due to their significant investment in dangerous bank products such as derivatives.

- Over debt public and private sector in many countries of OECD.

- Shadow banking system in emerging economies, China for example.

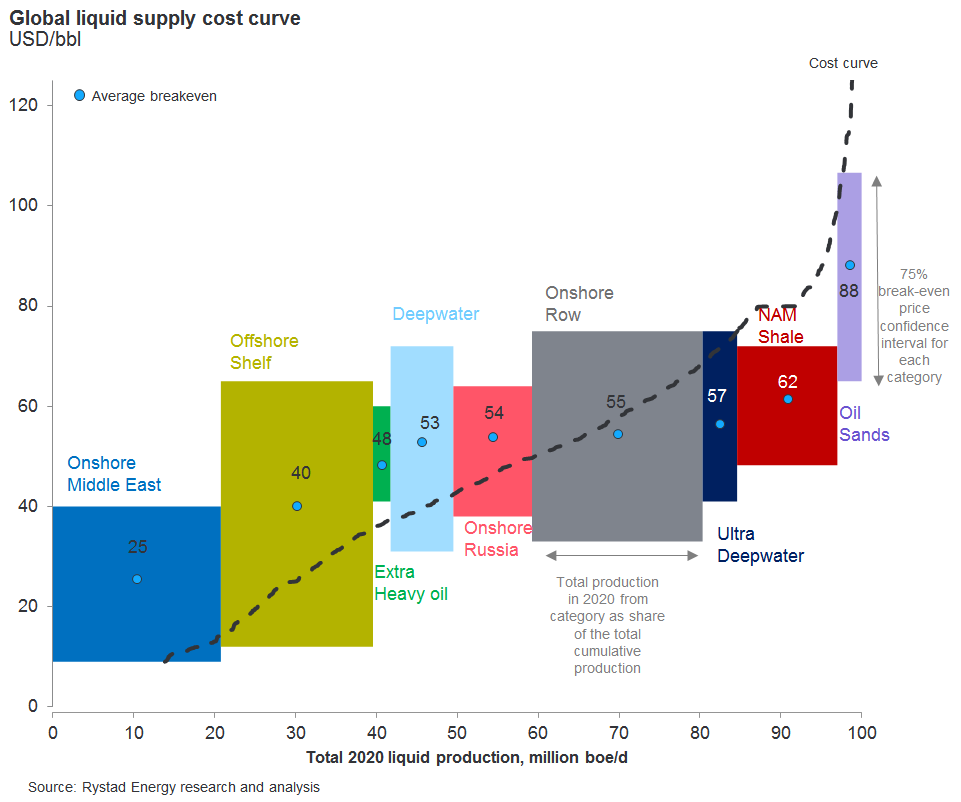

The oil and gas prices are the primary factor in deciding whether a reserve is economically feasible. Unconventional and offshore oil and gas fields have the highest costs of extraction among the reserves.

Global Liquid supply cost curve, By Rystad Energy, 15/02/2016, Source of the photo: http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases/2015-will-be-extraordinarily-tough-for-oil-companies

Finally to mention that a lot of oil and gas companies have a high amount of debts that must be repaid it until 2025, something which is tough to happen especially in a period of low oil prices. According to many analysts from IEA, international banks, and national energy authorities, the oil price will remain below 80$ until 2020 based on the public information of supply and demand of oil until the given date.

Although a recent article on www.oilprice.com mention that “According to the Wall Street Journal, citing financial research firm IPREO, oil and gas companies raised $255.7 billion through various public offerings and bond issues from 2007 through 2014. The total debt of the U.S. oil and gas companies, excluding Chevron and ExxonMobil, is expected to increase to more than $200 billion when all the 2015 financials come out. That’s a 55 percent increase since 2010—all fueled by higher oil prices at that time.” [2]

Social factors

These factors express migration, culture, religion, demography, income and ideological views on an issue. Some current social trends and beliefs that can affect significantly the oil and industry are:

- Increasing awareness and focus on more friendly fuels and decreasing in the use of “dirty” fossil fuels such as oil sands, coal, and shale gas.

- Oil Sands Production, Accessed at 18/02/2016, Elections Likely to Worsen Calculus for Canada’s Beleaguered Oil Industry, By Nick Cunningham, Source of the photo: http://energyfuse.org/elections-likely-to-worsen-calculus-for-canadas-beleaguered-oil-industry/

- Increasing global oil and gas consumption levels until 2040 due to the global increasing population.

- Natural gas is considered the cleanest fuel among the fossil fuels.

- National political/social debate among the society of many oil and gas rich countries will set the dilemma between energy security/profits from the extraction of oil and gas resources and protection of the environment.

Technological Factors

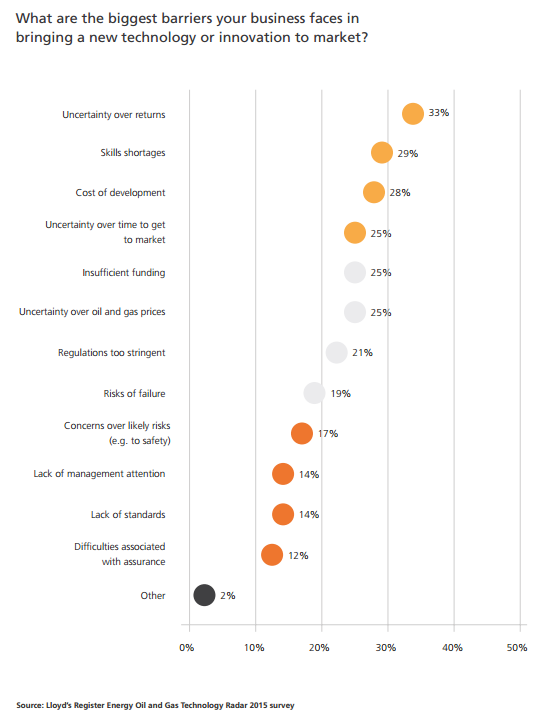

- Source: Lloyd’s Oil and Gas Technology Radar 2015 Report. http://www.lr.org/en/energy/technology-and-innovation/technology-and-innovation-radar/Based on the above graph the main barriers that oil and gas industry faces in bringing a new technology or innovation to the market are:

- Uncertainty over returns.

- Skill Shortages.

- The cost of development.

- Uncertainty over time to get to market

- Insufficient funding

- Uncertainty over oil and gas prices

- Regulations too stringent

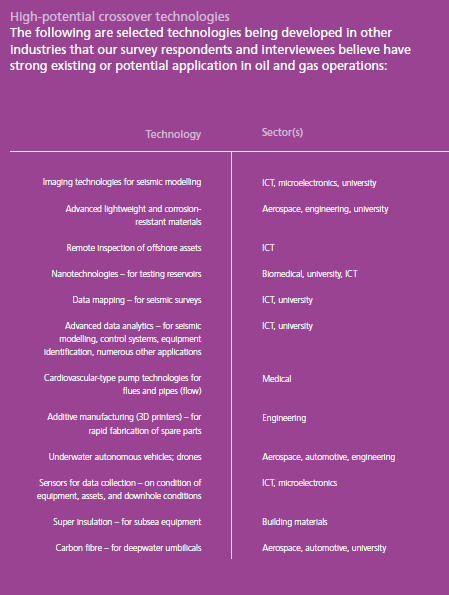

Some of the major high-potential crossover technologies that can affect the oil and gas industry in the future are:

- Source: Lloyd’s Oil and Gas Technology Radar 2015 Report. http://www.lr.org/en/energy/technology-and-innovation/technology-and-innovation-radar/

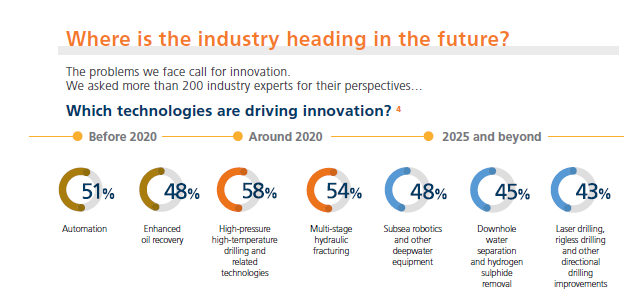

- Source: Lloyd’s Global Insights Oil and Gas Technologies 2015 Report, http://www.lr.org/en/energy/technology-and-innovation/global-insights/Based on the above graph and according to Lloyd’s Global Insights Oil and Gas Technologies 2015 Report the technologies which driving innovation within oil and gas industry are:Before 2020

- Automation

- Enhanced oil recovery

Around 2020

- High-pressure and high-temperature drilling and related technologies

- Multi – Stage hydraulic fracturing

2025 and beyond

- Subsea Robotics and other deep-water equipment

- Downhole water separation and hydrogen sulfide removal

- Laser drilling, rigless drilling, and other directional drilling improvements

Finally, to mention that one major technology that will also play a vital role in the future of oil and gas industry globally until 2030 is the Methane Hydrates extraction technology. Methane Hydrates deposits (probable and possible reserves) according to the experts of oil and gas industry are estimated more from the combination of oil, gas and coal economically exploitable reserves together. The development of this technology is profoundly connected with oil prices because it’s a not cheap and requires a lot of money for R&D. Leading countries in this technology are the USA, Japan, and Germany.

References

[1] Oil & Currencies: Understanding Their Correlation (USD, UUP) | Investopedia http://www.investopedia.com/articles/forex/092415/oil-currencies-understanding-their-correlation.asp#ixzz40DkUekh6

[2] Banks On The Hook For Bad Energy Loans | OilPrice.com Retrieved February 18, 2016, from http://oilprice.com/Energy/Energy-General/Banks-On-The-Hook-For-Bad-Energy-Loans.html

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Member of the Greek Energy Forum. He specializes in the development of oil & gas markets in Southeast Europe and the Mediterranean. Also, he is the owner of the website Energy Routes in which he publishes all of his articles for global oil and gas industry, http://energyroutes.eu/ The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis.

Your site is so fantastic. I’m going to come back here again.

This site is absolutely fabulous!

Very nice post. I simply stumbled upon your weblog and wished to say that I’ve really enjoyed browsing your blog posts. In any case I will be subscribing for your rss feed and I’m hoping you write once more soon!