By Athanasios Pitatzis

It was first on OilVoice at 23th of May 2016, http://www.oilvoice.com/n/Porters-Five-Forces-Model-for-the-Oil-Gas-Industry/c56bd619b3de.aspx

Porter’s Five Forces framework is one useful strategic tool to evaluate potential opportunities and threats/risks for the oil and gas industry. The five key factors of this model are:

- Competitive rivalry

- Threat of New Entrants

- Threat of Substitutes

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

Competitive rivalry

The competitiveness of oil and gas industry and especially in the upstream sector of the industry is significantly intensive. There are three different type of players in the upstream sector of the upstream sector, these are:

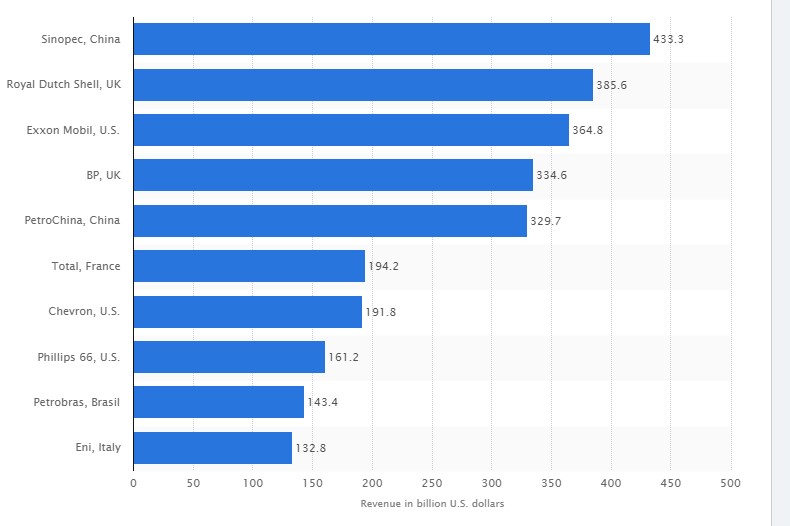

- The big IOCs or as we call it Integrated Oil and Gas Companies (private sector), based on the below graph these are:

Top oil and gas companies by revenue 2015 ranking | Statistic. (n.d.). Retrieved February 19, 2016, from http://www.statista.com/statistics/272710/top-10-oil-and-gas-companies-worldwide-based-on-revenue/

- Royal Dutch Shell 385.6 billion dollars revenue for 2015

- Exxon Mobil from USA 364.5 billion dollars revenue for 2015

- BP from UK 6 billion dollars revenue for 2015

- Total from France 194.2 billion dollars revenue for 2015

- Chevron from USA 8 billion dollars revenue for 2015

- Phillips 66 from USA 161.2 billion dollars revenue for 2015

- Eni from Italy 132.8 billion dollars revenue for 2015

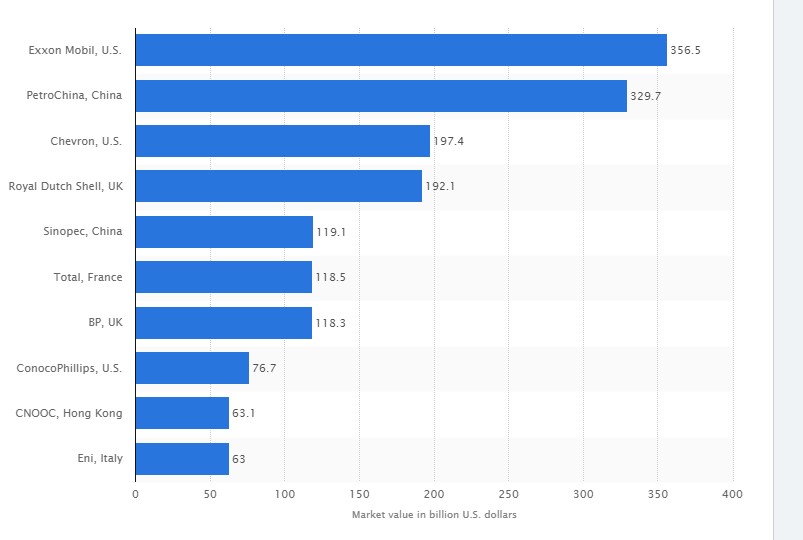

The above list based on the company revenues for 2015 in billion dollars. It is known, that the best indicator to observe the size of a company is its market capitalization. Based on the below graph the biggest private fully integrated oil and gas companies for 2015 were:

Top oil and gas companies based on market value 2015 | statistic. (n.d.). Retrieved February 19, 2016, from http://www.statista.com/statistics/272709/top-10-oil-and-gas-companies-worldwide-based-on-market-value/

- Exxon Mobil 356.5 billion dollars in market value

- Chevron 329.7 billion dollars in market value

- Shell 192.1 billion dollars in market value

- Total 118.5 billion dollars in market value

- BP 118.3 billion dollars in market value

- ConocoPhillips 76.7 billion dollars in market value

- Eni 63 billion dollars in market value

-

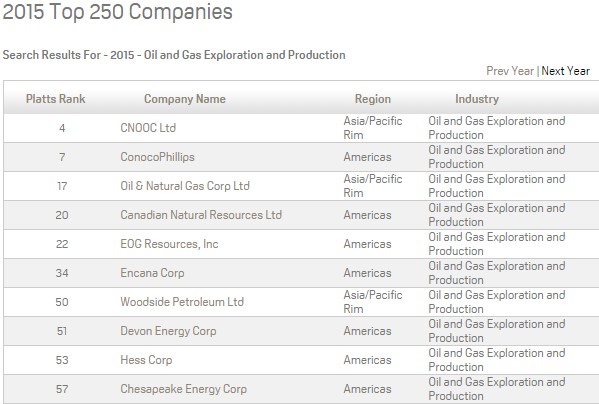

- One other category of companies are the private oil and gas companies which are operating only to upstream sector of oil and gas industry (Exploration and Production). Based on the below graph the biggest private Oil and Gas Exploration and Production Companies for 2015 are:

(Observe the graph for the names)

Platts Top 250 Rankings. (n.d.). Retrieved February 19, 2016, from http://top250.platts.com/Top250Rankings/2015/Region/OilandGasExplorationandProduction

- Finally, the last group of companies which control more than 90% of the proven oil and gas reserves are the National Oil Companies. Some of these major companies are:

Saudi Aramco, Saudi Arabia

National Iranian Oil Company (NIOC)

China National Petroleum Company (CNPC)

Petroleos de Venezuela (PDVSA)

Rosneft, Russia

Gazprom, Russia

Threat of New Entrants in Oil and Gas Industry

The factors that affect the newest companies to enter oil and gas business, especially the upstream segment are:

- Huge capital required

- National Oil Companies control more than 90% of the proven oil and gas reserves

- Increase of the internal competition within the industry

- The big oil and gas companies can increase their R&D spending which will give them a boost regarding innovation and improve existing technologies. This strategy will give them a competitive advantage over new oil and gas companies which now enter the industry. Also, to mention that this whole strategy of the big IOCs can force the new competitors to spend more money

- The big IOCs or as we call it Integrated Oil and Gas Companies which can easy compete with new competitors due to economics of scale

- Oil and Gas prices volatility

- Oil and Gas Reserves are usually located in war zones or geographical areas with geopolitical conflicts or political instability

- National and international law restrictions which can affect the new entrance of a company in the oil and gas business

Threats of Substitutes in Oil and Gas Industry

The main alternatives sources to oil and gas for producing energy which used for electricity, transportation, heating, etc. are:

- Nuclear Energy

- Coal

- Hydrogen

- Biofuels and other renewables sources such as solar and wind energy

These alternative sources of energy can replace a high amount of hydrocarbons use in the global energy mix according to their performance, quality and price of course. This strategy requires a big amount of investments in R&D and producing procedures, so the possibility for substitutes to dominate the global energy mix until 2040 is very small.

Bargaining Power of Buyers in Oil and Gas Industry

The main buyers of oil and gas products are:

- Refineries

- National Oil Companies

- International Oil and Gas companies

- Distribution companies

- Traders

- Countries (USA, China, Japan, countries of the EU, etc.)

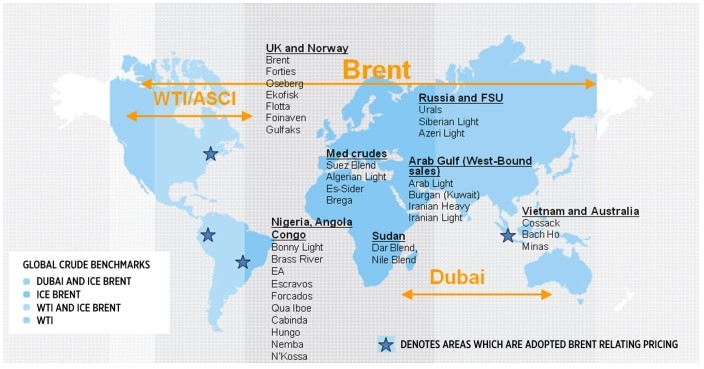

The bargaining power of buyers in oil and gas industry is relatively small due to the nature of this industry. Buyers are interested in the price and the quality of a product. It is known, that global oil benchmarks determine the oil price, the main oil benchmarks are:

- Brent Blend

- West Texas Intermediate (WTI)

- Dubai/Oman

Understanding Benchmark Oils: Brent Blend, WTI and Dubai | Investopedia. (n.d.). Retrieved February 22, 2016, from http://www.investopedia.com/articles/investing/102314/understanding-benchmark-oils-brent-blend-wti-and-dubai.asp

So it is obvious from the above that the buyers cannot affect the oil prices. Higher bargaining power have the buyers only which consume enormous amounts of oil and gas such as EU, China, USA, Japan, and India in comparison with other countries. Finally to mention that the only bargaining power of buyers in the oil industry is only what quality of the oil they will buy.

Benchmarks play an important role in pricing crude oil – Today in Energy – U.S. Energy Information Administration (EIA). (n.d.). Retrieved February 23, 2016, from http://www.eia.gov/todayinenergy/detail.cfm?id=18571

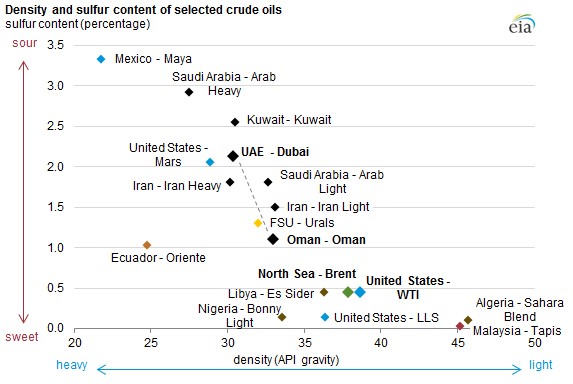

As we observe from the above graph, the buyers can choose from variety types of oil according to their quality characteristics (density and sulfur content), but all of them are pricing to the three known oil benchmarks that we have mentioned before. Also, until the consumers can use an alternative energy source instead of oil, the bargaining power of the buyers will be significant low.

Bargaining Power of Suppliers in Oil and Gas Industry

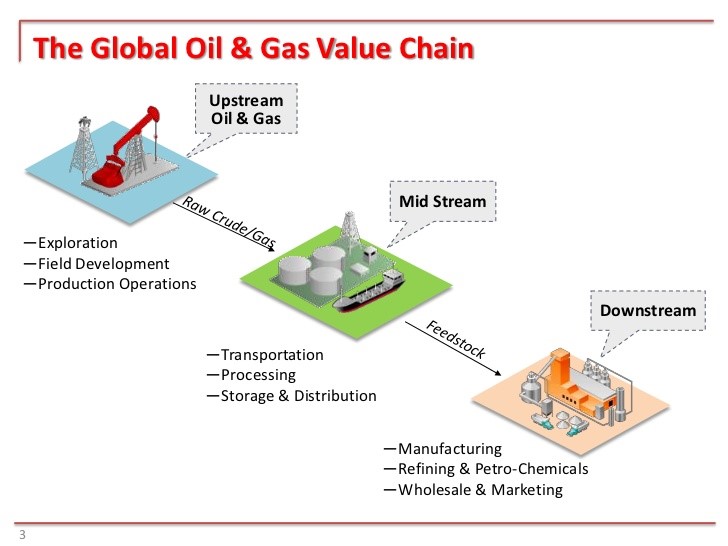

Some big suppliers in the oil and gas industry are fully integrated oil and gas industry (International and National Oil Companies) which are active in the whole value chain of oil and gas sector.

THE GLOBAL OIL & GAS INDUSTRY: PROSPECTS & CHALLENGES IN THE NEXT DEC…. (n.d.). Retrieved February 24, 2016, from http://www.slideshare.net/theoacheampong/theo-acheampong-presentation

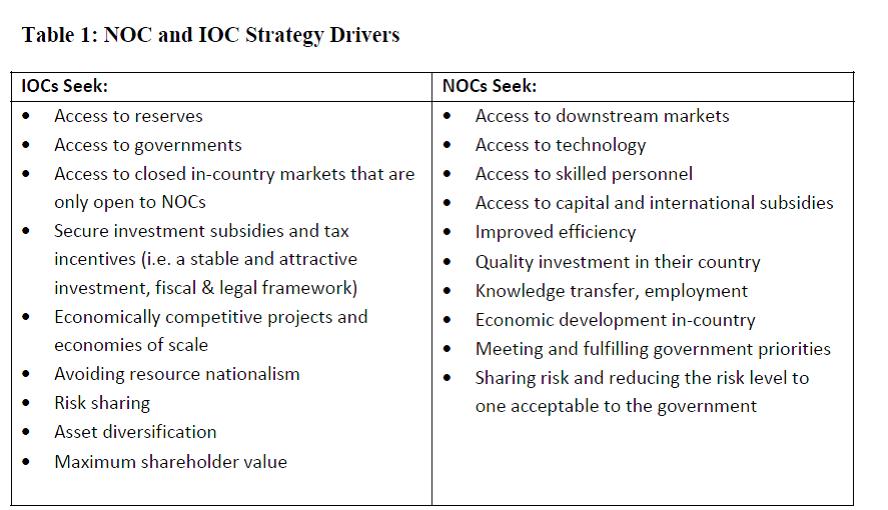

These companies can be the big International oil companies such as Chevron, Shell and Exxon Mobil or National oil companies such as Saudi Aramco, Gazprom, and Petrobras. The ability of those companies to affect oil prices and the industry is high due to their business involvement on all of the business segments of oil and gas industry, so their bargaining power is significantly greater than the buyers.Another great player in the side of the suppliers are the oil rich countries (as they call them oil producing countries) or else OPEC has a significant bargaining power. OPEC nations own at least 70% or the world’s oil proven reserves. Although these oil reserves have one of the lowest cost producing price between the oil industry in contrast with oil producing from oil sands and deep-water oil fields which are expensive regarding costs of production

8 reasons why the politics of oil have changed | World Economic Forum. (n.d.). Retrieved February 24, 2016, from http://www.weforum.org/agenda/2016/02/eight-reasons-why-the-politics-of-oil-have-changed?utm_content=buffere31e9&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

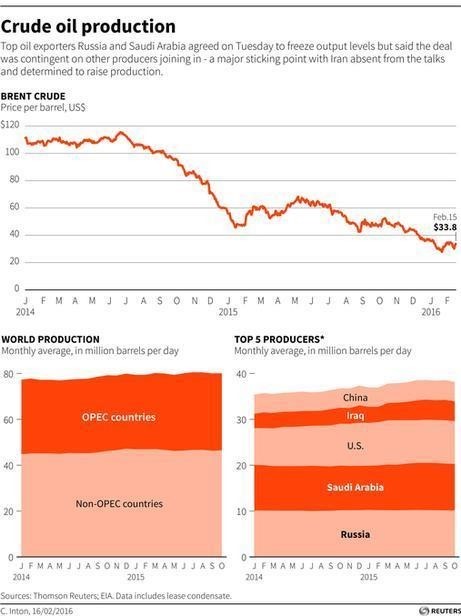

Based on the above graph from Reuters it is obvious that OPEC controls and more than the 30% of the world oil production per day which gives the ability to this organization to affect the global oil prices significantly by cutting or adding more production, so this give them also more bargaining power.On the other hand, some countries like Iran, Venezuela, and Mexico luck in any new oil and technologies due to the control of their oil sector from their oil stated companies. So this situation can drive countries such as Mexico to become importers of oil due to the fall in oil production because in the case of Mexico the oil and gas sector of this country was close to the international oil companies until 2014. In the case of the Venezuela, the national oil company was used as a political tool from the political elite of the country from 2000 and beyond, specifically was used to fund large, rich social project. This situation has driven the economy of Venezuela and of course the government budget to increase its dependence on oil revenues. At the same time, Venezuela has closed its oil sector to foreign oil and gas companies with result to be close to bankruptcy at the beginning of 2016.Some general characteristics for National Oil Companies are:

- Unlike the IOCs, the NOCs are governmentally controlled, and they usually manage a country’s hydrocarbons resources.

- Having been given the privilege to the domestic reserves, the aim of the NOCs is, differently than the IOCs, not monetization, but:

- serving the national interests,

- supporting the local economies and

- even protecting the territorial environments

Source: Ledesma, D., 2009. The Changing Relationship between NOCs and IOCs in the LNG Chain Oxford Institute for Energy Studies

The future for IOCs and NOCs is likely one in which they will both compete and co-operate, but their bargaining power will be significant high until an alternative source of energy will be discovered in the future which can replace hydrocarbons.

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Member of the Greek Energy Forum. He specializes in the development of oil & gas markets in Southeast Europe and the Mediterranean. He is also the owner of the website Energy Routes where he publishes all his articles covering the global oil and gas industry. The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis.

First of all I want to say wonderful blog! I had a quick question that I’d like to ask if you do

not mind. I was interested to find out how you center yourself and clear your head before writing.

I have had difficulty clearing my mind in getting my thoughts out.

I truly do take pleasure in writing however it just seems

like the first 10 to 15 minutes are lost simply just trying to figure out how to begin. Any

suggestions or hints? Kudos!

Your site is so fantastic. I’m going to come back here again.

This site is absolutely fabulous!

Hey there! This post could not be written any better!

Reading this post reminds me of my good old room mate!

He always kept chatting about this. I will forward this page to him.

Pretty sure he will have a good read. Thanks for sharing!

Nice post. I be taught one thing more challenging on totally different blogs everyday. It’ll always be stimulating to learn content from different writers and observe slightly something from their store. I?d favor to make use of some with the content on my weblog whether you don?t mind. Natually I?ll offer you a link in your web blog. Thanks for sharing.

I am very happy to read this. This is the kind of manual that needs to be given and not the accidental misinformation that is at the other blogs. Appreciate your sharing this greatest doc.

Thank you so much for sharing this wonderful post with us.

Thanks for another fantastic article. Where else could anybody get that type of info in such an ideal way of writing? I have a presentation next week, and I am on the look for such info.

Nice i really enjoyed reading your blogs. Keep on posting. Thanks

This article is a refreshing change! The author’s distinctive perspective and insightful analysis have made this a truly fascinating read. I’m appreciative for the effort he has put into crafting such an enlightening and thought-provoking piece. Thank you, author, for providing your wisdom and igniting meaningful discussions through your exceptional writing!

Hey! This is my first visit to your blog! We are a group of volunteers and starting a new project in a community in the same niche. Your blog provided us useful information to work on. You have done a marvellous job!