By Athanasios Pitatzis

In today’s article we will cover the possibilities if the resent merger between Shell and BG Group can affect the Cyprus gas export options.

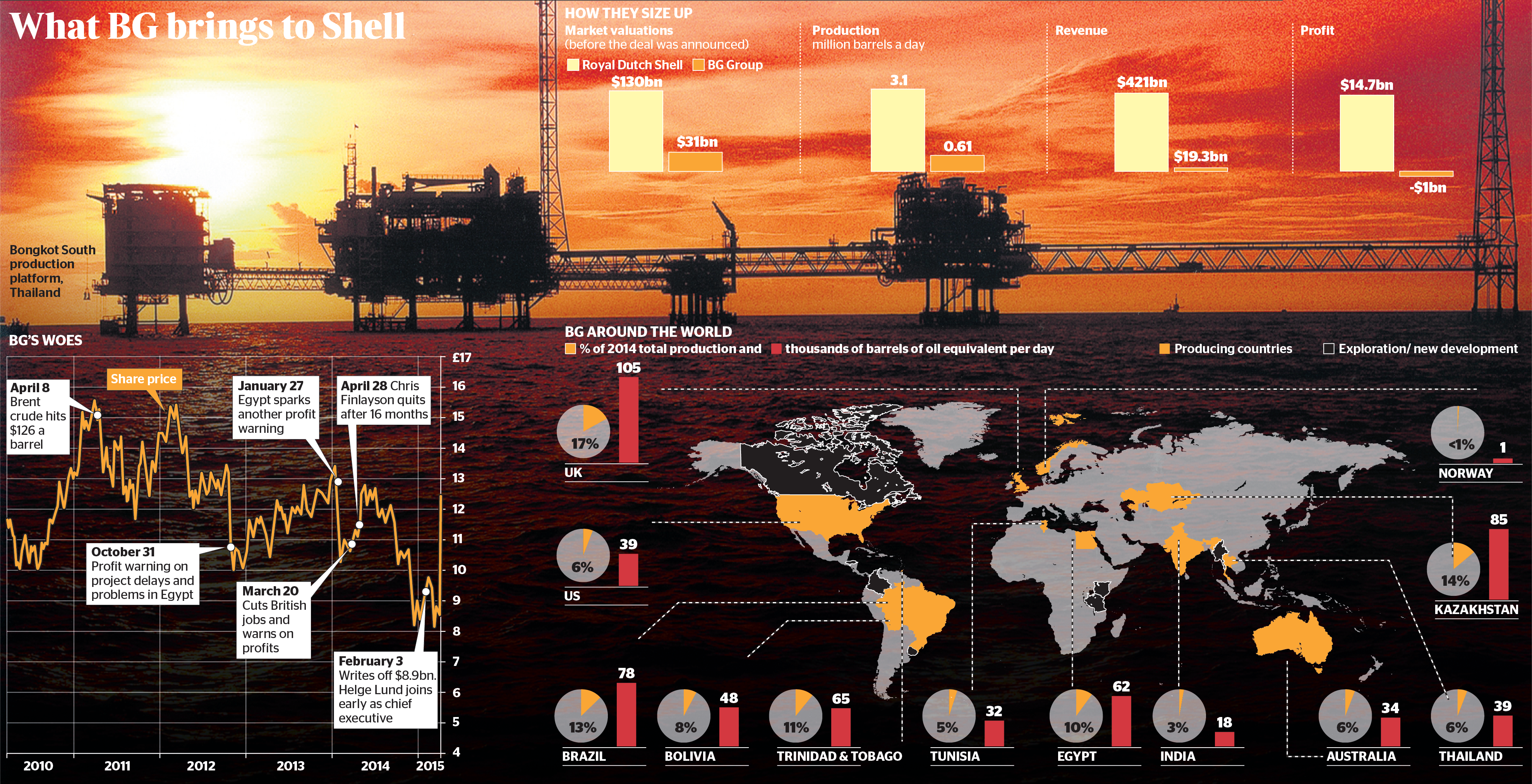

First of all to mention that after this merge Shell is very well positioned in East Mediterranean natural gas market because BG Group had many quality assets in Egypt natural gas market.

BG Group

BG Group has two business segments: Upstream, which includes Exploration & Production and Liquefaction; and LNG Shipping & Marketing. The Group has interests in more than 20 countries on five continents. [1]

Source of the photo: Annual Report 2014 BG Group

It is obvious that the company is a medium size company of oil and gas industry with a very interesting portfolio (upstream and LNG assets worldwide)

Source of the photo: Annual Report 2014 BG Group

Source of the photo: Annual Report 2014 BG Group

BG Group Egypt Assets

According to the Databook 2014 of the company BG Group’s business in Egypt comprises:

- Operatorship of two gas-producing areas offshore the Nile Delta:

- the Rosetta Concession and

- the WDDM Concession

- Operatorship of three other concessions offshore the Nile Delta:

- El Manzala Offshore (EMO)

- El Burg Offshore (EBO) and

- North Gamasa Offshore (NGO)

- Non-operated interest in the East El Burullus Offshore Concession (EEBO) and

- Major shareholdings in the two-train Egyptian LNG project

Source of the photo: Databook 2014 BG Group

Source of the photo: Databook 2014 BG Group

BG Group owns a significant number of LNG vessels.

Shell Geopolitical Perspective

According to the Annual Report of Shell MENA (Middle East and North Africa) operations come from oil producing fields in Oman, the UAE and Iraq.

Source of the photo: Annual Strategic Report of Shell for 2014

It is obvious from the above graph that Shell has commercial activities also in Qatar, Turkey and Saudi Arabia. The geopolitical perspective of shell will be very different from this of BG Group was.

Business and Geopolitical environment of upstream sector of East Mediterranean

Some facts about the business environment:

- Global low oil prices affect deep-water activities and make them unprofitable for the companies

Source of the photo:http://www.rystadenergy.com/AboutUs/NewsCenter/Newsletters/UsArchive/us-q1-2015

The above graph proves that with prices under 66$ per barrel deep-water activities will be unprofitable. Although according to the Rystad Energy Analysis with payback time 8 years and IRR to 23% but with prices to 90$ per barrel, the upstream outlook of upstream on East Mediterranean seems very gloomy. From the business point of view this means that the operators of the region like Noble Energy to develop new oil and gas fields suck as Leviathan and Aphrodite they will need big amount of cash flow (bank loans or bonds). [2]

- Recent antitrust Israel authority actions make the business environment of Israel upstream sector even more complicated. Also according to the website Globes Israel business arena (http://www.globes.co.il/en/ ) and Eco Energy CEO Amit Mor maybe Royal Shell will not want to be linked with Israel due to the others Shell Middle East business activities. Additionally the recent agreement between west and Iran maybe opens new business opportunities for companies like Shell. It is obvious that the final agreement between Leviathan partners and Shell (BG Group before the merge) for exporting natural gas from Leviathan field through LNG liquefaction facility in Idku, Egypt will not an easy one. Finally we must take consideration that Shell owned 20% of the shares in Woodside and this company walked out from Israel oil and gas sector recently.[3]

- Security threats for oil and gas infrastructures on East Med from Libya ISIS Rebels or maybe even from Syria.

Some facts about the Geopolitical Environment:

- Israel, Egypt and Cyprus we can mention that they have very complicated foreign relationships with Turkey, this affect the business environment in the region and make it even gloomy. Also if we put in the picture and Greece with the financial crisis in the country, then the situation is even more complicated.

- Iran nuclear recent agreement can have significant implications for the global oil and gas industry such as:

- Open a new market for the IOCs with a big amount of oil and gas proven reserves

- Can drive the oil prices even more lower to 20 or 30 $ per barrel if we take into consideration that Iran had 35 million barrels stocked in tankers waiting to flow the market according to the international media.

If we summarize all the above if Cyprus and Israel Regulatory authorities don’t join forces to force the operators of Leviathan and Aphrodite fields to take action soon then in one or two years the situation will be irreversible.

Cyprus and Israel join forces to export their natural gas

In today’s low price of oil environment the companies show us that the cooperation is needed to avoid unsuitable situations, so Israel and Cyprus must join forces and evaluate their natural gas export options together. Let’s examine these options one by one:

Exports by pipeline to Egypt for domestic use

According to the in-Cyprus website “Egypt sees this need to import gas for domestic use as short term. Egypt believes concessions awarded to IOCs over the past year, such as BP, ENI, Total and BG, underpinned by new discoveries in the Nile Delta, will restore the country to energy self-sufficiency by 2018 and stop the need for gas imports by 2020. In addition, domestically produced gas would cost from $3.50 to $5.00 per mmBTU, whilst gas piped from Cyprus would cost $7-$8.[4]

On this basis, it is difficult to see how this could help the development of Aphrodite. Not only is it expensive gas in comparison to Egyptian gas, but by the time the Aphrodite project is completed (the earliest in 2019), Egypt will no longer require gas imports ” [4]

Exports by pipeline to Egypt’s LNG plants

According again to the in-Cyprus website “There are two main challenges to the success of Cyprus gas sales to Egypt:

- MoUs have been signed with Leviathan and Tamar to supply gas that will take about 70% of the capacity of the two LNG plants, with the remainder taken by BG and BP gas in Egypt.[4]

- Prices for LNG delivered to Europe and Asia are about $7 per mmBTU. The cost, excluding profits, of transporting Aphrodite gas to Idku, liquefying it, shipping to Europe and regasifying it may be of the order of $11 per mmBTU. This may make such a project uneconomical at least for the time being. ” [4]

Also we must take consideration that the next years more quantities of LNG will flow to the markets from North America due to the shale revolution, Australia and maybe Brazil and some other countries of South East Asia, these actions will drive the prices even lower unless if we have a significant increase in the demand of LNG.

CNG of FCNG is maybe the only commercial solution for exporting the natural gas of the East Mediterranean to Europe and to the local markets

Source of the photo: http://www.cyprusgasnews.com/archives/6258/east-meds-natural-gas-comparative-advantage-lies-in-regional-markets/

Source of the photo: http://www.cyprusgasnews.com/archives/6258/east-meds-natural-gas-comparative-advantage-lies-in-regional-markets/

We must mention that CNG its suitable for reservoirs until 5 Tcf, you can find more information about that in this link: http://www.cyprusgasnews.com/id/wp-content/uploads/2014/07/The-advent-of-FCNG-now-presents-the-possibility-of-a-Phased-Development-for-East-Med-Hydrocarbons.pdf so Leviathan reservoir partners is a question if they can use CNG as an option for exports.

Finally if someone wants more information about CNG Technology can observe a specific article in this link: http://www.cyprusgasnews.com/archives/6258/east-meds-natural-gas-comparative-advantage-lies-in-regional-markets/

Conclusion

The development of oil and gas fields of East Mediterranean will be a challenge project for oil and gas companies. We would like to conclude with some scenarios which involve the development of Leviathan and Aphrodite reservoirs, these are:

- Shell sells the LNG facilities in Egypt in some other company, but this action is to opposite direction of the strategy of Shell because according to their annual report the company wants to focus to deep-water and LNG business activities in the future.

- Recently BG had signed an agreement with Egypt to develop and produce new gas fields for $4 billion, so what Shell will do with this agreement and what implication can have this agreement in the region if Shell implement 100% of this agreement in Cyprus and Israel gas export options.

- Shell sign a final agreement with Leviathan partners, if the prices of LNG increase in the near future

- Aphrodite gas reservoir development can delay for 2-3 years yet due to the low – oil prices

- The low – oil prices can force medium size companies like Noble Energy to avoid investments in high risky projects like this in East Mediterranean and force them even to abandon these projects, we have seen this scenario in the past in many cases.

- A consortium of oil and gas companies which operate in the region join forces to develop the Aphrodite and Leviathan fields with FCNG or FLNG option for exports. This consortium can involve Noble Energy and Delek as operators of these reservoirs and Shell and BP as the big players of the region. This consortium of companies can have the ability to find loans from the international markets more easily.

The future of the upstream sector in the East Mediterranean seems very challenging and the resent merge between Shell and BG Group can make the outlook of the region even more complicated or promising.

It was first published on Cyprus Gas News, available link: http://www.cyprusgasnews.com/archives/8017/can-the-merge-between-shell-and-bg-group-affect-the-cyprus-gas-export-options-shell-can-affect-the-oil-and-gas-sector-of-east-mediterranean/

Athanasios Pitatzis

Assistant Director – Oil and Gas Analyst for CyprusGasNews

Production and Management Engineer, Democritus University of Thrace, 2014-2015 Postgraduate student in TEI Eastern Macedonia and Thrace (Kavala) in the Masters of Science in Oil and Gas Technology (http://msc.petrotech.teikav.edu.gr/). I write articles on Greece within a variety of internet web portals in the fields of Geostrategy, Geoenergy and energy policy. Also I possess a Certificate-Seminar E-Learning on Geopolitics and Security Issues in the Islamic Complex Turkey-Middle East from Ethnikon and Kapodistriakon University of Athens. Member of Society of Petroleum Engineers, SPE Section of Kavala (http://www.spe-kavala.org/ ) (http://spe.org/ )

References:

[1] Information of the Annual Report of BG Group for 2014, http://www.bg-group.com/

[2] The oil price is falling but so is the breakeven price for shale, by Rystad Energy,http://www.rystadenergy.com/AboutUs/NewsCenter/Newsletters/UsArchive/us-q1-2015

[3] Shell acquisition of BG jeopardizes Leviathan deal, Published by Globes [online], Israel business news – www.globes-online.com – on April 15, 2015, © Copyright of Globes Publisher Itonut (1983) Ltd. 2015 , http://www.globes.co.il/en/article-shell-acquisition-of-bg-endangers-leviathan-deal-1001028563

[4] Exporting gas to Europe and Egypt, By in- Cyprus, http://in-cyprus.com/exporting-gas-to-europe-and-egypt/

Leave a comment