By Athanasios Pitatzis

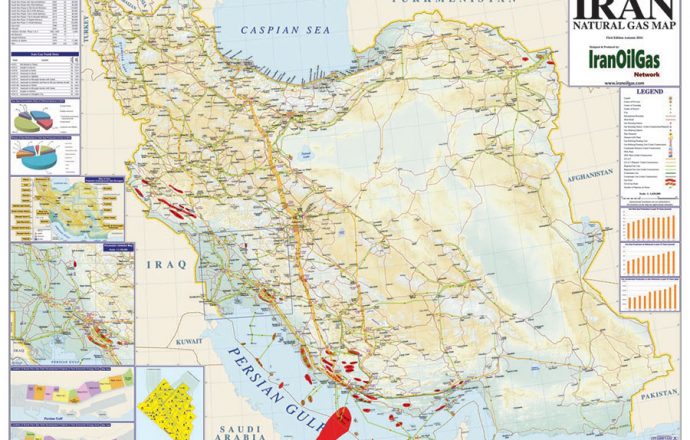

According to BP’s latest report Statistical Review of World June 2017 on global energy issues, Iran has on its territory the world’s largest recoverable natural gas reserves which are 33.5 trillion cubic meters of natural gas.

Iran’s geopolitical and economic problem is that it relies upon its economic prosperity heavily in its energy sector. According to a recent study by the World Bank, Iran’s economy grew by 13.4% in 2016, while in 2015 it grew at only 1.3%. The dramatic increase in GDP in 2016 was largely due to the country’s oil and gas sector, in particular, GDP growth that is directly or indirectly related to oil increased by 60% in 2016 due to the increase in oil production and its export to international markets. Similarly, GDP growth unrelated to the oil sector was only 3% for 2016.

It is well known that Iran holds the world’s fourth-largest recoverable oil reserves (158.4 billion barrels of oil) and its oil exports account for 95% of Iran’s Petroleum Sector exports. In fact, Iran’s prosperity for the next 10 to 15 years will depend on its oil exports. This complex economic situation is a typical example of the “Dutch Disease” which affects all countries that base their economic development on the exploitation of their natural resources. In particular, the development of a single sector of the economy (oil) and the gradual depreciation and economic decline of the other sectors of the economy. Iran’s geopolitical and energy strategy is largely related to the above problem, which can be aggravated if the nuclear agreement collapses and the international community imposes again economic sanctions on the country.

The only strategy that Iran can immediately implement to address this problem is the partial diversification of its oil sector exports, with an increase in gas exports. The growth of other sectors of the economy may take decades or at least 15 to 20 years, a geopolitical time that Tehran does not have.

Currently, Iran is consuming 95% of its natural gas production mainly for electricity production, to inject it into old oil fields to maintain its level of production at economic levels and to meet domestic industrial and commercial gas demand. Iran gas exports are about 5 to 10 billion cubic meters to Turkey and Armenia / Azerbaijan with corresponding pipelines, and these quantities in some cases and according to domestic gas demand covered by natural gas imports from Turkmenistan. The increase in gas exports will be achieved only with the drastic increase of Iran’s natural gas production. To achieve this goal, Iran will need foreign direct investment and a strategic transfer of know-how mainly from Western oil and gas companies. Even if geopolitical reality improves and companies come to the country, Iran has many institutional weaknesses that put huge obstacles and lags in the development of the country’s natural gas fields. Some of these weaknesses are bureaucracy, lack of infrastructure, inflation, access to bank lending, and possible political turmoil.

Even in the best case scenario that gas production increases despite all of the above obstacles and domestic demand does not increase, so there are quantities to export, Iran’s strategic dilemma will be to develop new pipelines to new local markets (to Iraq, the United Arab Emirates, Oman, Afghanistan, India, Pakistan and Kuwait) or LNG exports and direct global competition with countries such as the US, Qatar, and Australia that will dominate the global LNG market for the next upcoming 15 years. . The stability of Iran virtually is depending on a geopolitical thread that the unpredictable US President can cut at any time, by imposing new sanctions

This article was firstly published in Greek Language by the Greek News Website Liberal.gr, Link: http://www.liberal.gr/arthro/194777/apopsi/arthra/energeiako-kai-oikonomiko-stratigiko-dilimma-tou-iran-einai-oi-exagoges-fusikou-aeriou-i-lusi.html

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Alternate Committee Member of the Greek Energy Forum. He specializes in the development of oil & gas and power markets in the UK and the Southeast Europe and the Mediterranean. Also, he is the owner of the website Energy Routes in which he publishes all of his articles for the global energy industry, http://energyroutes.eu/ . He has published more than 50 energy opinion articles in major Greek and English Energy websites (in English: Natural Gas Europe, Europe Energy Review, OilVoice, International Petroleum Students Magazine, Resources Global Network Magazine, About Oil Magazine and Rigzone) Currently, is working as PV Performance and Monitoring Analyst in the UK. (His LinkedIn Profile: https://www.linkedin.com/in/thanospitatzis/ ).The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis.

References:

- BP Statistical Review of World June2017, https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

- World Bank (Παγκόσμια Τράπεζα), Report with title: Iran’s Economic Outlook – October 2017, 11/10/2017, http://pubdocs.worldbank.org/en/810181507054517387/MEM-Oct2017-Iran-ENG.pdf

- By Nizan Feldman, and Sima Shine, Iran’s Economic Situation Two Years after the Removal of the Sanctions, INSS (The Institute for National Security Studies), Israel, 04/01/2018, http://www.inss.org.il/publication/irans-economic-situation-two-years-removal-sanctions/

Link to the photo: http://www.iranoilgas.com/exclusive/map