By Athanasios Pitatzis

Brexit probably would have several effects in the energy sector of Great Britain, but not irreversible. As far the European energy security, we believe that despite Brexit the cooperation between the United Kingdom (UK) and the European Union (EU) would deepen, because of the interdependence. Also, we want to emphasise that despite the Brexit, UK would choose to remain a member of the European Energy Union perhaps based on the Norwegian or Swiss model.

European Energy Security, Brexit and UK growing Energy dependence on imports

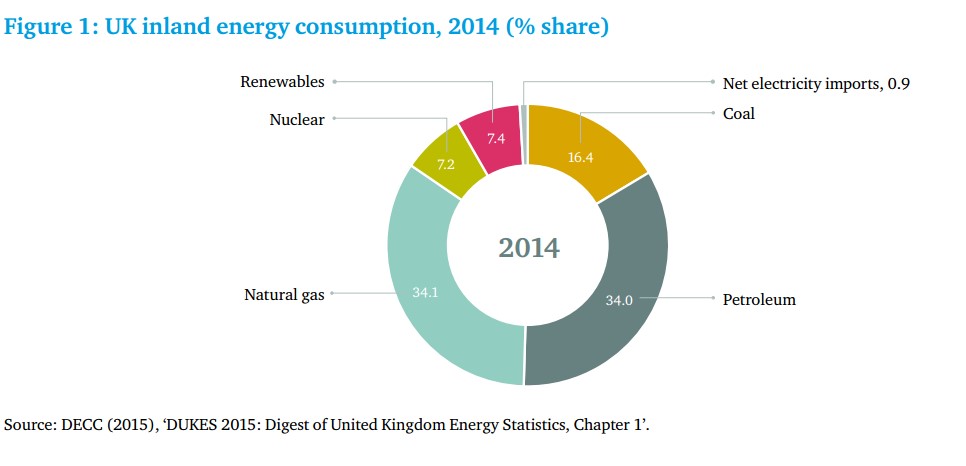

UK Inland Energy Consumption (2014, % share), Source: UK Unplugged? The Impacts of Brexit on Energy and Climate Policy Report, By Antony Froggatt, Thomas Raines and Shane Tomlinson, Chatham House, May 2016, https://www.chathamhouse.org

As we can see from the above chart, the energy mix of Great Britain is based mainly on fossil fuels and more specifically:

- 34% in oil

- 1% in Natural Gas

- 4% in Lignite / Coal

- 2% in Nuclear Energy

- 4% on Renewable Energy Sources and

- 9% of electricity imports from neighbouring countries

Three future energy strategies for the United Kingdom after Brexit would be to:

- Replace coal with natural gas, which can import in the form of liquefied natural gas – LNG from various sources, such as the US. The introduction in LNG form is advantageous because it is expected up to 2025 global LNG prices averaged approximately 4 – 8 $ / BBtu, because there is an oversupply of the US and Australia. Through this strategy, the country will succeed and its environmental objectives.

- Increasing the role of nuclear power and renewable energy sources in the future energy mix

- Open up new areas in the UK, European and Foreign companies for exploration and production of hydrocarbons in the UK Exclusive Economic Zone.

It is also evident from the following figures that Great Britain needs the European Union Energy to secure its energy needs in collaboration with its European neighbours, mainly to Norway, France and the Netherlands.

UK Gas and Electricity Imports for the year 2014, Source: UK Unplugged? The Impacts of Brexit on Energy and Climate Policy Report, By Antony Froggatt, Thomas Raines and Shane Tomlinson, Chatham House, May 2016, https://www.chathamhouse.org

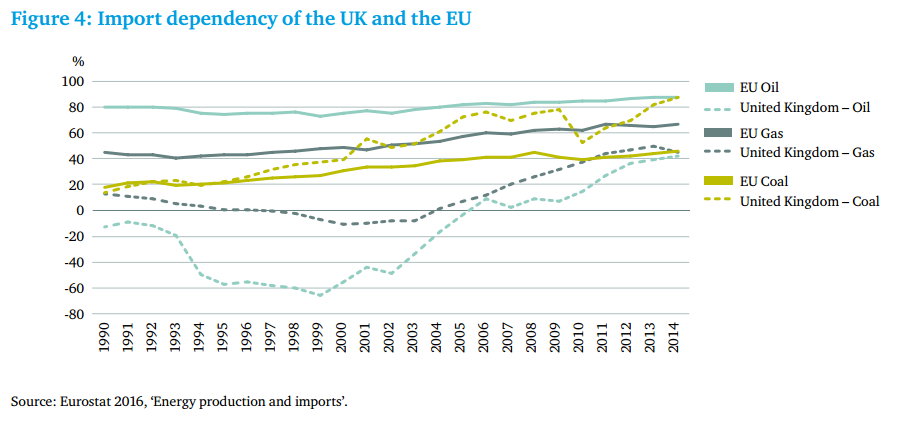

Furthermore, it is evident that the UK, like the EU, is dependent on massive hydrocarbon imports. Of course, it is remarkable to note that UK is the largest oil producer and the second gas producer in the EU of the 28 states (27 after Brexit).

Fossil Fuels Dependency of the UK and the EU, Source: UK Unplugged? The Impacts of Brexit on Energy and Climate Policy Report, By Antony Froggatt, Thomas Raines and Shane Tomlinson, Chatham House, May 2016, https://www.chathamhouse.org

According to the diagram above, the UK energy dependence is:

- By about 40% in oil consumption

- By about 45% for natural gas consumption and

- By about 90% in Coal consumption.

Risks for the UK Energy Sector over the upcoming years

- Brexit and its impact to the UK Energy Sector

- Will the European Investment Bank continue to support energy projects in the UK after Brexit? According to below graph, from 2011 until 2015 EIB have invested in the UK 29, 1 billion euros, 28% of these investments were in the energy sector of the UK. (observe the graph below)

EIB Lending in the UK, 2011 to 2015, Source: Brexit: future funding from the European Investment Bank? https://secondreading.uk/economy/brexit–future–funding–from–the–european–investment–bank/

- Limited new human capital for the UK energy companies due to new immigration law by the UK government after Brexit

- Uncertain UK Energy Regulatory Environment over the years of negotiations between the UK and the rest of the EU (possibly new changes in the status of electricity and gas interconnectors with France, the Netherlands and Ireland and energy trading)

- Decreasing domestic oil and gas production, especially if the UK bans permanently domestic shale gas production in the future

- According to the UK government the three most major identified risks/case studies over UK Gas Market are:

- Infrastructure failure

- Freezing weather and infrastructure failure

- Geopolitical events

- According to the International Index of Energy Security Risk 2016 Edition, UK energy security ranking is decreasing. (from 1 in 2005 to 6 in 2016)

- Increasing government intervention and energy subsidies can reduce/damage UK Energy Sector Competitiveness

- Closed off UK Coal Power plants until 2025 can increase the probability of increasing the UK wholesale gas and electricity prices

Our analysis indicates that the biggest risk for the UK Energy Sector is to be excluded from the European Internal Energy Market after the Brexit negotiations. Many of the risks for the UK Energy Sector (especially after Brexit) which are indicated in this analysis are confirmed by the National Grid of the UK in a recent article by Reuters.

Brexit and Future Challenges for the UK Energy Sector

According to Chatham House Report UK Energy Sector will face many problems which will depend on to the trade model of cooperation the UK will have after the Brexit negotiations with the European Union, some of the uncertainties/possibilities can be:

- The degree of access to the European gas and electricity markets;

- The extent to which the UK would lose the capacity to influence EU decision-making on energy policies, about what it would gain regarding sovereign power to design distinct national energy policies;

- The ease with which a deal might be negotiated with other EU states and institutions.

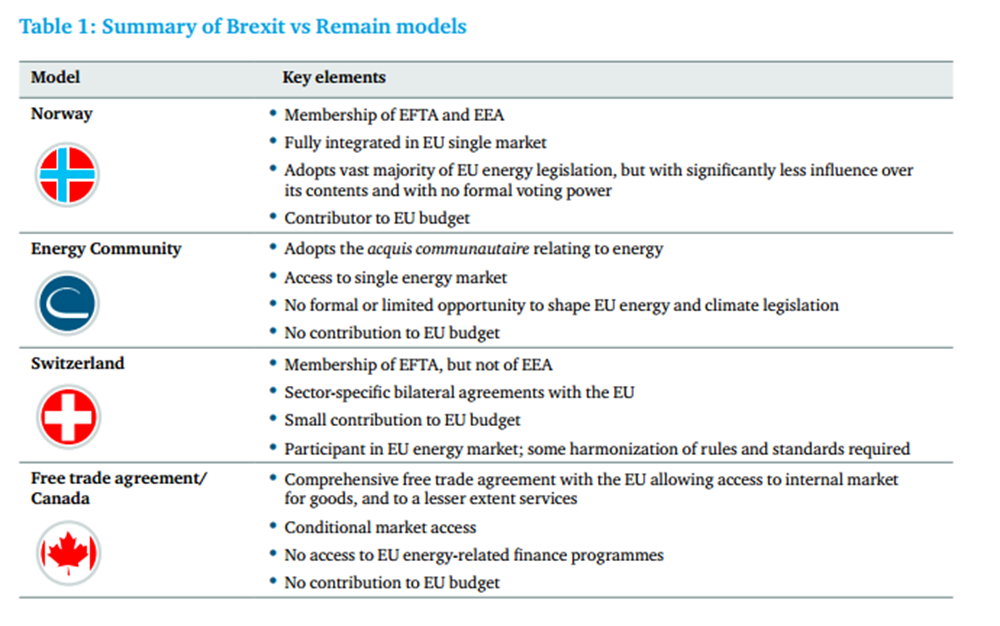

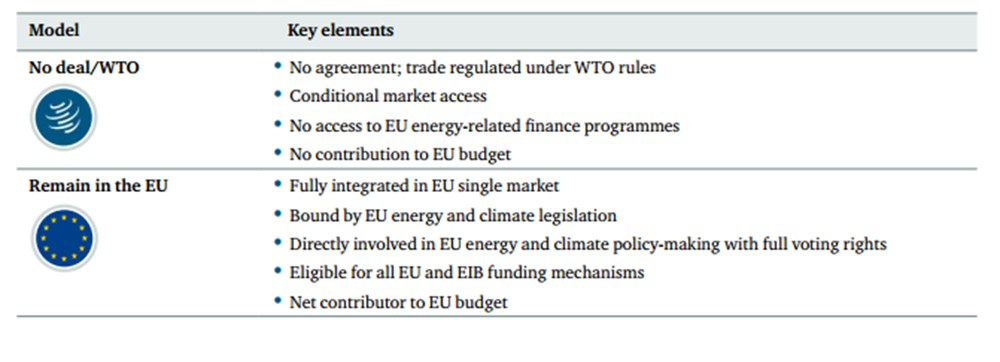

Furthermore, after Brexit UK could follow one of the following trade models with the EU regarding energy, these models are:

- The Norwegian Model

- The Energy Union model

- Swiss Model Free Trade Agreement with EU –

- Canadian Model

- No trade deal with the EU – Model according to the World Trade Organization

Summary of Brexit vs Remain Trade Models, Source: UK Unplugged? The Impacts of Brexit on Energy and Climate Policy Report, By Antony Froggatt, Thomas Raines and Shane Tomlinson, Chatham House, May 2016, https://www.chathamhouse.org

It is evident from our analysis that the future challenges for the UK Energy Sector will be:

- The future trade model between the UK and the European Union

- The future UK Energy Mix regarding UK Energy Security (Gas and Nuclear vs Renewables and Energy Storage)

- The future shale gas domestic development in the UK

- The increasing dependence on energy imports

- In which type of renewables should the UK Energy Sector invest more money and develop?

- In which new renewable energy technologies UK Energy companies should focus their R&D innovation?

The current risks and future challenges for the UK Energy Sector is a dynamic process, so the overall results of our analysis can change rapidly in the near future due to unpredicted geopolitical, economical, policy, social or technological factors.

References

- Brexit: future funding from the European Investment Bank? https://secondreading.uk/economy/brexit-future-funding-from-the-european-investment-bank/

- International Index of Energy Security Risk 2016 Edition, Institute for 21st Century Energy, http://www.energyxxi.org/sites/default/files/energyrisk_intl_2016.pdf

- UK Unplugged? The Impacts of Brexit on Energy and Climate Policy Report, Chatham House, https://www.chathamhouse.org/sites/files/chathamhouse/publications/research/2016-05-26-uk-unplugged-brexit-energy-froggatt-raines-tomlinson.pdf

- Country Analysis Brief: United Kingdom, U.S Energy Information Administration (EIA), https://www.eia.gov/beta/international/analysis_includes/countries_long/United_Kingdom/uk.pdf

- National Grid warns of costs if Britain exits EU energy market, Reuters, 20/01/2017, http://in.reuters.com/article/britain-eu-energy-costs-idINL5N1FA35V

This article was first published to Young Petro International Petroleum Students Magazine Spring Edition 2017 on March 2017, original link:

Athanasios Pitatzis is an Industrial/Petroleum Engineer and Member of the Greek Energy Forum. He specializes in the development of oil & gas and power markets in the UK and the Southeast Europe and the Mediterranean. Also, he is the owner of the website Energy Routes in which he publishes all of his articles for global oil and gas industry, http://energyroutes.eu/ The opinions expressed in the article are personal and do not reflect the views of the entire forum or the company that employs the author. Follow Greek Energy Forum on Twitter at @GrEnergyForum and Athanasios at @thanospitatzis. Currently lives in the UK